Trend Report Action

The Dutch company Action has established itself as a key player in European retail in recent years. With its low prices and expansive growth strategy, Action has captured the attention of both consumers and the industry alike. As the company prepares to enter the Swiss market on April 5, 2025, in Bachenbülach (ZH), many questions arise: How does Action’s business model work? What makes the company so successful, and what challenges might it face during expansion?

This trend report answers the ten most important questions about Action – from the background of its corporate strategy and supply chain to sustainability aspects and a price comparison with Temu. The goal is to provide a comprehensive overview that highlights the dynamics and relevance of Action. This report was published in January 2025.

The trend report is based on extensive research, including an in-depth analysis of studies and newspaper articles about Action, a review of annual reports from both Action and investor 3i (which holds an 80% stake in the company), as well as a detailed price comparison conducted in November 2024 and January 2025. In addition, we visited five Action stores in southern Germany and Austria to closely examine the product range and stores on site. All of these findings form the foundation for answering the ten key questions about Action.

Last updated: March 2025

Trend Report: Action

1. Who is Action? Where does the company come from, how are its revenue and profits developing, and how has Action evolved since its founding?

Action is Europe’s fastest-growing non-food discounter, which has experienced rapid expansion since its founding in 1993 in Enkhuizen, the Netherlands. The company, headquartered in Zwaagdijk, is now 80 percent owned by the London-based private equity firm 3i (Action 2024a). Action has increased 3i’s share value by over 1,000 percent, made up 66 percent of its portfolio, returned at least £2.9 billion to the main shareholder, and is considered the “jewel of its portfolio” (Financial Times, 2024).

Action offers a wide range of everyday products at low prices, placing emphasis on offering both private labels and well-known brands at affordable rates. Today, Action employs around 72,000 people and operates more than 2,650 stores across 12 European countries, reaching over 17 million customers weekly in its physical stores and an additional 6.5 million customers online (Action, 2024b; Action, 2024c). However, products cannot be purchased online. With an assortment of approximately 6,000 items—including 1,500 products priced under one euro—and the introduction of around 150 new products each week, Action aims to capture market share in the highly competitive discount retail sector (Action, 2024b; Action, 2024c).

Since its founding in 1993, Action has achieved impressive growth. By 2003, the company had reached 100 stores in the Netherlands and opened its first store in Belgium in 2005. Expansion into the German market followed in 2009, quickly followed by entry into other European countries. This rapid growth was accelerated by the British investor 3i, which invested in the company in 2012. That same year, Action entered the French market, followed by Austria and Luxembourg in 2015, Poland in 2017, and the Czech Republic in 2020.

In 2018, Action celebrated its 25th anniversary and opened its 1,500th store in 2019. Expansion continued at a rapid pace, surpassing the 2,000-store mark in 2022. In 2023, the company entered Slovakia, followed by Portugal in 2024, bringing the total number of stores to over 2,650 across 12 countries (Action, 2024c).

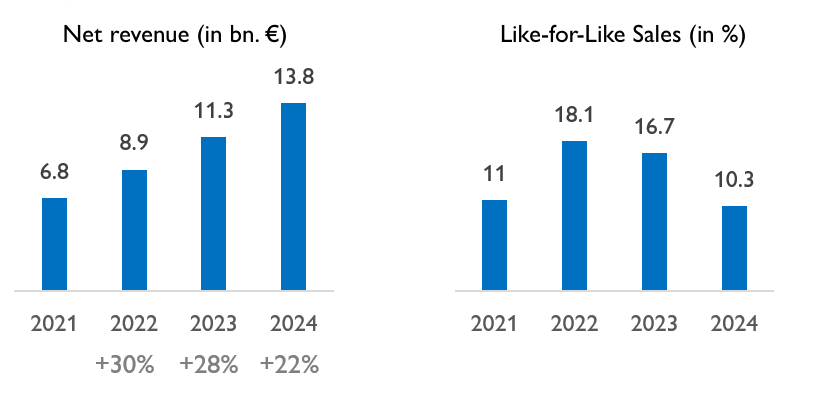

As the store network grew rapidly, so did revenue. In 2012, Action reported revenues of €873 million. By 2023, this figure had soared to €11.3 billion (Action, 2023). Revenue increased by 27.8 percent compared to the previous year. On a like-for-like basis, the increase was a slightly lower 16.7 percent, as the number of stores grew by 303 in 2023 to a total of 2,566 across Europe (Action, 2023; see Fig. 1). Earnings before interest, taxes, depreciation and amortization (EBITDA) rose by 46 percent in 2022 to €1.2 billion (Zeit, 2024). For 2023, Action reported an EBITDA of €1.615 billion, an increase of 34 percent year-over-year (Action, 2023). In 2024, net revenue increased to €13.8 billion (+21.7 percent); like-for-like sales growth amounted to 10.3 percent (Action, 2025). No information is available regarding EBIT or net profit.

Compared to other retail companies, Action has achieved not only significantly faster but also highly profitable growth in recent years – something many fast-growing non-food online retailers have not been able to match. This demonstrates that brick-and-mortar retailers can also achieve above-average success.

Action. (2024a). Governance. https://company.action.com/this-is-action/governance/

Action. (2024b). Wir sind Action. https://www.action.com/de-de/ueber-uns/wir-sind-action/

Action. (2024c). Historie. https://www.action.com/de-de/ueber-uns/historie/

Action. (2025). Action 2024 net sales grow 21.7% to €13.8 billion; like-for-like growth 10.3%. https://company.action.com/pressreleases/action-2024-net-sales-grow-21-7-to-e13-8-billion-like-for-like-growth-10-3/

Financial Times. (2024). 3i searches for next ‘gem’ as short seller circles. https://www.ft.com/content/968b427f-0b2d-4723-80d6-014b9796f8c0

Zeit. (2024). Non-Food-Discounter Action mit Umsatzplus. https://www.zeit.de/news/2024-02/01/non-food-discounter-action-mit-umsatzplus

2. How does Action manage to offer such low prices? Where do the products come from and how does the supply chain work?

When looking at the income statement of a retail company, procurement costs carry particular weight. For non-food retailers, this cost category often accounts for 50–70 percent of revenue. For this reason, low procurement prices and an efficient supply chain are fundamental to the economic success of discount retailers.

-

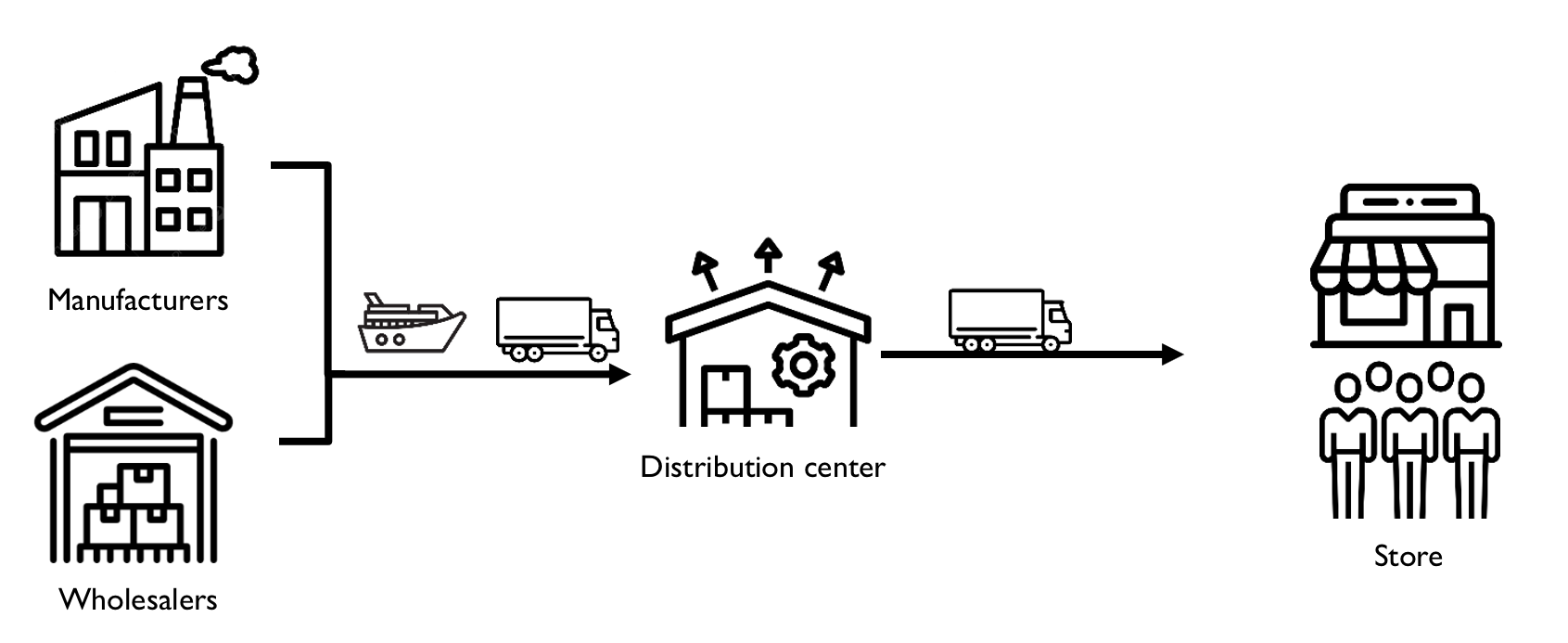

Direct sourcing: Action procures a large share of its products directly from manufacturers (Action, 2023), with many suppliers based in China. Reliability is a key factor when selecting suppliers. Action leverages economies of scale by purchasing in large volumes (Action, 2023). A more detailed description of the supply chain is shown in Fig. 3.

- A core company motto is "simply consistent". As Action (2023) puts it: "One brand, one store format, and one way of working. This allows us to keep our processes simple and efficient".

- With a range of 6,000 items, Action’s product assortment is relatively compact and less complex compared to competitors (Action, 2024b).

- Action primarily offers non-food items, which do not have expiration dates and require no complex logistics (no refrigeration, no perishable goods, no special storage requirements) (NZZ, 2024). Perishable fresh products are rarely sold (Kleine Zeitung, 2024).

- Action relies on word-of-mouth recommendations from highly satisfied customers, keeping marketing expenses low (Luzerner Zeitung, 2023).

- Stores are located in so-called C-locations – typically on city outskirts or in retail parks and shopping centers in rural areas –where rents are low (NZZ, 2024).

49% of products sold at Action come from China (Action, 2023). Another 6% are from other Asian countries, and 45% are sourced from Europe (Action, 2023). Action works with a total of 686 suppliers across Europe and Asia (Action, 2023). Some products are sourced directly from factories and manufacturers, while others come through wholesalers and importers (Action, 2023). Products are delivered directly to Action’s distribution centers, which are located in the Netherlands, Slovakia, France, Germany, and Poland, and from there, stores are supplied at least twice per week (Action, 2024c; Action 2025).

Action’s distribution centers are highly efficient. Employees use computer-assisted systems that monitor every step and second of their tasks (DRC Discount Retail Consulting GmbH, 2022), maximizing productivity and minimizing costs. Roll containers are packed strictly according to guidelines and quickly prepared for transport. Employees have performance targets, such as the number of boxes they must move per hour (DRC Discount Retail Consulting GmbH, 2022).

Action uses double-decker trucks (Dobos, 2017; see Fig. 2), which can carry 60% more goods than conventional trucks, to transport merchandise from distribution centers to stores (Action, 2022; Logistikpunk, 2025; Werwitzke, 2024).

Additionally, efficiency in store logistics is boosted through a standardized assortment and optimized processes that simplify both staff deployment and shelf stocking (DRC Discount Retail Consulting GmbH, 2022).

Over the past years, Action has succeeded in building a highly efficient supply chain (see Fig. 3). This includes long-standing supplier relationships, a lean yet complex supplier network involving multiple countries, and logistics that are significantly more cost-effective than those of competitors. This represents a key competitive advantage for Action.

References

Action. (2023). The Action Story. https://update.action.com/update2023/the-action-story

Action. (2024a). Action. https://www.action.com/de-ch/

Action. (2024b). Unsere Produkte. https://www.action.com/de-ch/ueber-uns/unsere-produkte/

Action. (2024c). Unsere Filialen. https://www.action.com/de-ch/ueber-uns/unsere-filialen/

Action. (2025). Häufige Fragen – Bestellen. https://www.action.com/de-de/kundendienstseite/faq/bestellen/

DRC Discount Retail Consulting GmbH. (2022). Netherlands: this is why the Action is so cheap. https://www.discountretailconsulting.com/post/netherlands-this-is-why-the-action-is-so-cheap?

Dobos, L. (2017). Logistikimmobilien: Und Action! https://logistik-heute.de/news/logistikimmobilien-und-action-14270.html

Kleine Zeitung. (2019). Was hinter dem rasant wachsenden Diskonter Action steckt. https://www.kleinezeitung.at/wirtschaft/wirtschaftktnhp/5581954/Fuer-Schnaeppchenjaeger_Was-hinter-dem-rasant-wachsenden-Diskonter

Logistikpunkt. (2025). Neue Doppeldecker für die Post https://www.logistikpunkt.ch/de/pages/logistik/2015/neue-doppeldecker-fuer-die-post?

Luzerner Zeitung. (2023). Neue Konkurrenz für die Migros und Co.: Der holländische Billigst-Discounter steht in der Tür. https://www.luzernerzeitung.ch/wirtschaft/non-food-hollaendischer-billigst-discounter-steht-in-der-tuer-ld.2528599

NZZ. (2024). Der Discounter Action erobert Europa im Sturm – funktioniert sein Erfolgsrezept auch in der Schweiz? https://www.nzz.ch/wirtschaft/action-der-discounter-erobert-europa-und-auch-die-schweiz-ld

Werwitzke, C. (2024). Discounter Action setzt E-Lkw zur Warenlogisitk ein. https://www.electrive.net/2023/03/21/discounter-action-setzt-e-lkw-zur-warenlogistik-ein/

3. What product categories does Action offer, and what role do the different product groups play in the assortment?

From a consumer perspective, the product assortment and price levels play a crucial role. Ultimately, attractive assortments and low prices are what draw consumers into stores. The following section describes various assortment and pricing measures employed by Action.

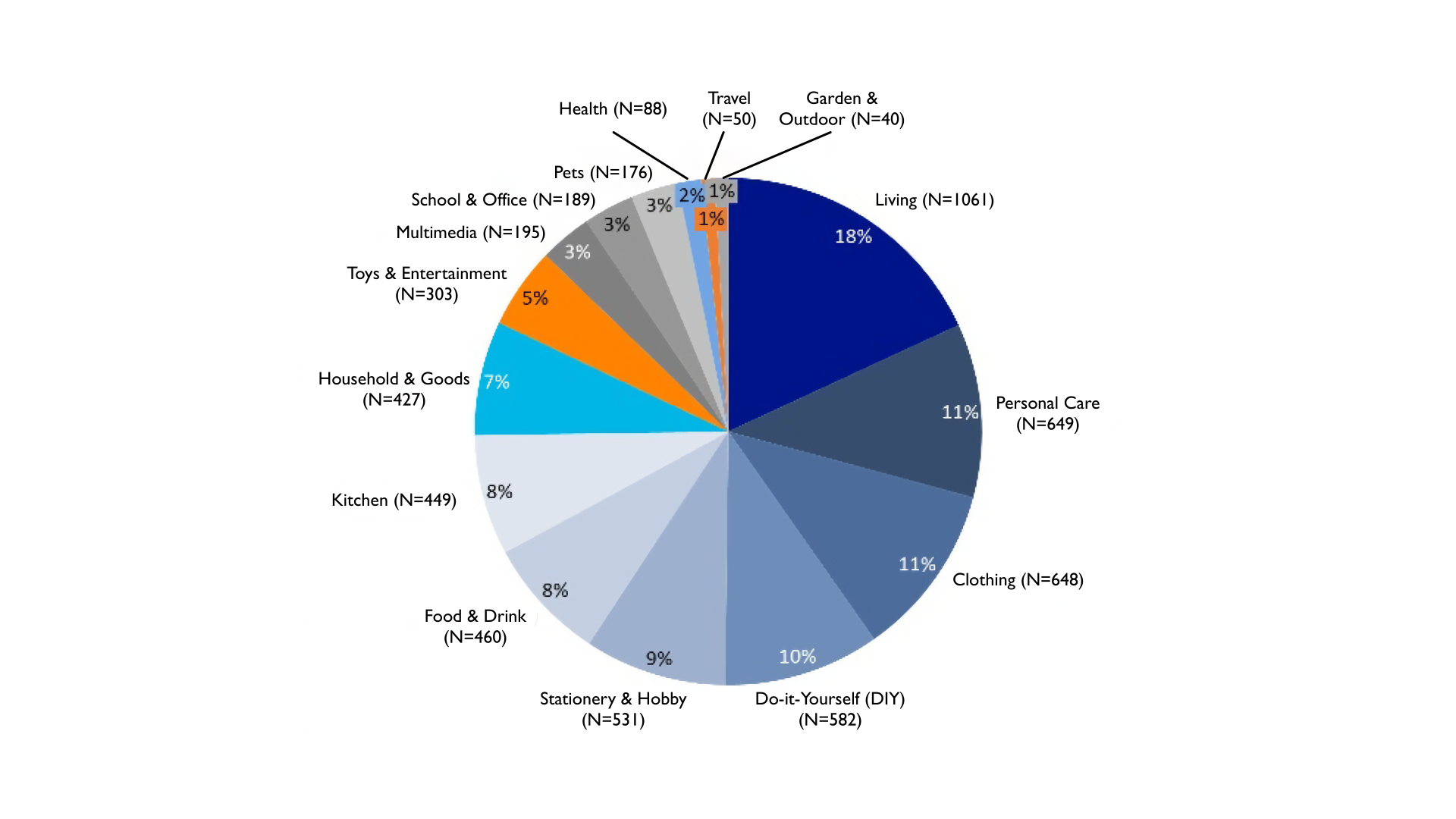

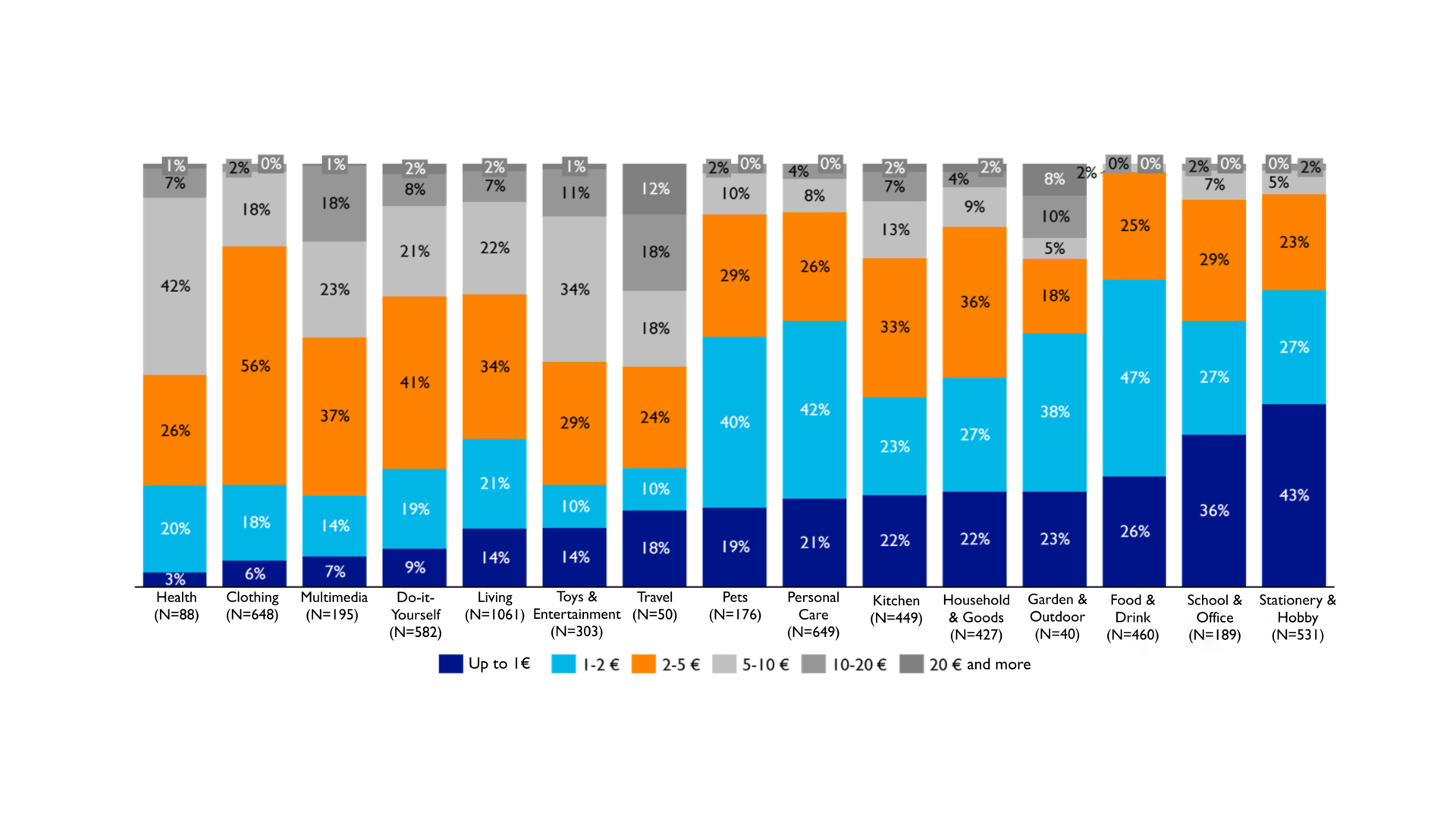

Action’s assortment consists of 14 non-food categories (see Fig. 4), comprising around 6,000 products in total. Two-thirds of these product groups are frequently updated with new items – approximately 150 new products each week. About a quarter of the assortment, or as previously mentioned, 1,500 products, are offered for a maximum of one euro (Action, n.d.-a). In Switzerland, the company promises to offer 1,500 products for under two francs. Overall, only about 8 percent of the assortment costs more than five euros. In addition to its large non-food range, Action also offers a selection of beverages and snacks, consisting exclusively of packaged, shelf-stable products, which eliminates the need for fresh or refrigerated goods (Bachmann, 2024). Action offers 488 well-known A-brands alongside 73 private labels (Action, 2023). Notable brands include Coca-Cola, Philips, and Umbro.

Fig. 4: Overview of Action’s product assortment

The categories on the German website differ from the official product categories on Action’s international website (see Fig. 5). Instead of 14, there are 15 categories in Germany, with slightly different groupings. For example, the German website includes additional categories such as "Travel" and "School & Office", while the categories "Linen" and "Laundry & Cleaning" are missing. As of October 23, 2024, the German website lists 5,848 products. A detailed overview of how these items are distributed across categories can be found in Fig. 5.

As a non-food discounter, Action has set the goal of offering “high-quality and surprising everyday products at low prices” (Action, n.d.-b). Our analysis of the website reflects this. In total, 1,093 products (18.60% of the assortment) are available for under one euro. Furthermore, 4,589 products (approx. 78.47%) cost less than five euros, and only 372 items (6.36%) are priced above ten euros. Figure 5 provides a detailed breakdown of product groups. The three largest categories by number of products are "Home" with 1,061 items (18.14% of the assortment), "Personal Care" with 649 items (11.10%) and "Fashion" with 648 items (11.08%) In calendar week 43 of 2024, 114 products were heavily discounted due to weekly promotions. The in-store assortment may differ slightly from the online offering, depending on the size of each branch (Action, 2024).

Action’s assortment is characterized by a wide variety of low-price items under five euros, with a focus on non-food products (see Fig. 6). With weekly new arrivals and particularly affordable special offers, the company attracts customers to its stores and reinforces its low-price image. The large share of products priced under one euro further enhances this perception. In addition to its website, Action also offers a mobile app, where customers can browse the product catalog and view special deals – similar to the website.

To view upcoming weekly offers in the app, customers must make a purchase in a physical Action store and scan their digital loyalty card at checkout. After doing so, they gain one month of access to the next week’s offers in the app. This app is currently not available in Swiss app stores.

Action. (n.d.-b). Wir sind Action. https://www.action.com/de-de/ueber-uns/wir-sind-action/

Action. (2023). Company factsheet. https://company.action.com/wp-content/uploads/2023/07/230720_Company-Factsheet_all-countries_ENG.pdf

Action. (2024). Produkte. https://www.action.com/de-de/

Bachmann, D. (2024, April 10). Der Discounter Action erobert Europa im Sturm. https://www.nzz.ch/wirtschaft/action-der-discounter-erobert-europa-und-auch-die-schweiz-ld.1824145

4. How important is the omni-channel approach for Action?

Many retail companies have developed a distribution system that combines physical stores with online shops. This approach is commonly referred to as omnichannel management. Changing consumer behavior demands such an omnichannel offering, as customers use both physical and digital sales channels. A modern retailer must therefore take both forms of distribution into account. But does this also apply to Action?

Anyone who visits Action online will find a list of all products and offers currently available in stores. The website also allows users to locate the nearest store and check product availability. However, there is no ordering function. Action deliberately chooses not to sell through an online shop, as doing so would result in significant financial losses. For this reason, the website cannot be considered a typical online shop – it is more accurately described as an online communication channel.

In this context, Action does not follow a traditional omnichannel strategy, where customers can shop both in-store and online. Online purchasing is not available at Action. This is primarily due to high delivery costs, which would be disproportionate to the average product price – often below five euros. Instead, the website showcases the assortment, promotes new products, answers questions regarding availability, and mainly focuses on highlighting the very low prices.

Therefore, we conclude that Action operates a modern but adapted form of omnichannel management. However, physical retail locations clearly remain at the core of the company’s distribution strategy.

5. How often does Action change its assortment, and how does that work? What advantages does this bring to customers?

One characteristic that sets Action apart from other non-food discounters lies in the constant change of its assortment. While competitors such as TEDi or Woolworth offer more than 3,000 items priced at one euro in the entry-level price segment, Action (see Question 3) limits itself to a total assortment of 6,000 items, of which only 2,000 belong to the standard assortment (WiWo, 2024). The remaining 4,000 items on Action’s shelves are regularly exchanged. On average, 150 new items are added each week in order, according to the company, “to remain relevant for our customers and to quickly respond to changing demand” (Action, 2023a). CEO Hajir Hajji refers to this as the “Action formula”, which contributes to the company’s current success and growth (Business Insider, n.d.).

To manage this assortment dynamic operationally and still operate profitably, an efficient supply chain and a standardised store concept are necessary (Action, 2023a; Action, n.d.-a). The assortment itself plays an important role in this regard, as it is 95 percent identical in all stores, which reduces procurement costs and benefits logistics (Meyer & Maros, 2024; Mitsis, 2023). We were able to confirm this after comparing the assortments of two stores in Germany and Austria (see Question 10).

Additionally, although the assortment in Germany includes products from 15 different product categories, offering a high breadth, the depth of assortment in individual product lines is quite limited (Action, 2023b; Bachmann, 2024). This, in turn, supports the quick sell-through of individual items, though it may lead to dissatisfaction among selective customers with specific expectations in terms of colours or sizes (Bachmann, 2024; Mitsis, 2023). To ensure this occurs as rarely as possible and that newly added products align with customer preferences, procurement plays a strategic role. Action conducts regular customer satisfaction analyses and surveys, including insights from various touchpoints throughout the purchasing process, to ensure ongoing assortment improvements based on current trends and customer preferences (Action, 2023c).

With the aforementioned frequent assortment changes, which ensure high relevance and up-to-dateness, Action hits the zeitgeist (referred to as variety seeking) and continuously offers customers a new and thus exciting shopping experience. The objective is clear: Action aims to maintain high store traffic. New products spark interest, and customers leave the store each time satisfied with one or more discovered bargains (Bachmann, 2024).

The main reasons for visiting Action are low prices, but also the perceived quality and wide selection appear to resonate with surveyed customers (Meyer & Maros, 2024). The concept is working and is reflected in steadily rising visitor numbers in now more than 2,600 stores. These stores are visited weekly by 17.3 million customers (Action, n.d.-b).

Action. (2023a). The Action Story. https://update.action.com/update2023/the-action-story

Action. (2023b). Action in 2023. https://update.action.com/update2023/action-in-2023

Action. (2023c). Taking Action – Offering affordable, good quality products. https://update.action.com/update2023/offering-affordable-good-quality-products

Action. (n.d.-a). Our distribution centers. https://company.action.com/this-is-action/our-distribution-centres/

Action. (n.d.-b). Company homepage. https://company.action.com/

Bachmann, D. (2024). Der Discounter Action erobert Europa im Sturm. https://www.nzz.ch/wirtschaft/action-der-discounter-erobert-europa-und-auch-die-schweiz-ld.1824145

Business Insider. (n.d.) Billig-Discounter Action in Deutschland: Mit dieser „Formel“ machte die niederländische Kette mehr Umsatz als Lidl. https://www.businessinsider.de/wirtschaft/handel/billig-discounter-action-macht-globus-lidl-konkurrenz-dank-action-formel/

Mitsis, K. (2023). Lohnen sich die Angebote? Billig-Discounter boomen - 3 große Ketten sind jetzt auf dem Vormarsch. https://www.focus.de /finanzen/news/geiz-ist-geil-billig-discounter-boomen-3-grosse-ketten-sind-jetzt-auf-dem-vormarsch_id_227360916.html

Meyer, M, & Maros, K. (2024). «Extrem günstig» – sie shoppen heute schon bei Action. https://www.tagesanzeiger.ch/action-kinderspielzeug-und-haarspuelung-fuer-weniger-als-1-euro-479675927043

WiWo. (2024). Aldi und Lidl verlieren Marktanteile an Action und Co. https://www.wiwo.de/unternehmen/handel/non-food-handel-aldi-und-lidl-verlieren-marktanteile-an-action-und-co-/30033280.html

6. How cheap is Action in Switzerland – and how does it compare to Temu in terms of price?

Using a price comparison, we answer the question of how inexpensive Action’s prices are compared to those of the Chinese marketplace provider Temu. Additionally, we compare Action’s prices in Switzerland with those in Germany to assess how affordable Action truly is in Switzerland.

Temu is known for its low prices and has already gained significant market share in Switzerland. With Action entering the Swiss market in April 2025, another low-cost competitor has arrived. This means that Action could also gain market share alongside Temu. To explore this, we compared prices at Action in Austria with prices at Temu. Prices at Action Austria are slightly higher than in Germany, which is why we selected Austria as the basis. This provides an initial impression of Action’s price competitiveness.

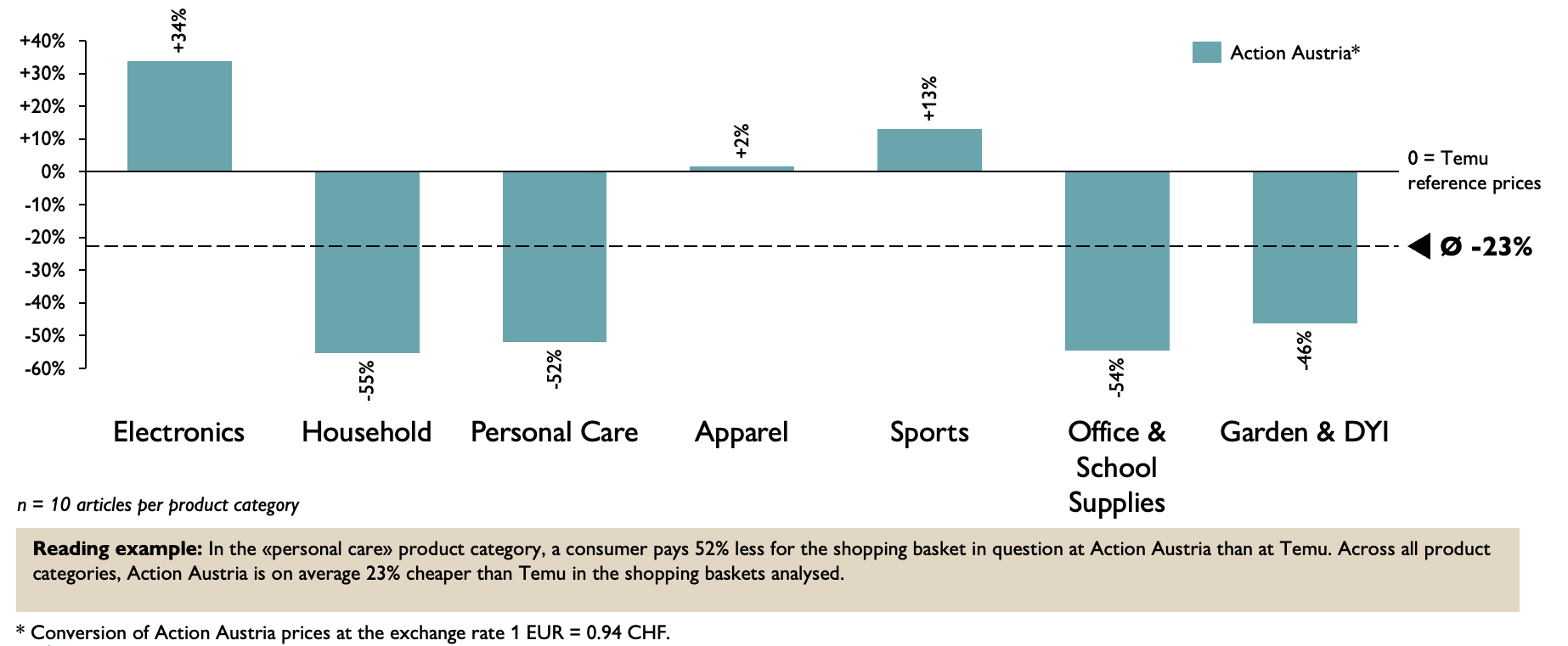

The price comparison between Action (Austria) and Temu (Switzerland) regarding entry-level pricing shows that a comparable shopping basket at Action (Austria) is on average 23 percent cheaper than at Temu (Switzerland). The price differences vary by product category (see Fig. 7). We chose the seven product categories shown in Fig. 7 because they are available in both Temu’s and Action’s product ranges and consist of basic products. The largest differences are found in the categories "Household" (-55%), "Office & School Supplies" (-54%), "Personal Care" (-52%), and "Garden & DIY" (-46%). Action (Austria) is more expensive than Temu (Switzerland) in the categories "Electronics" (+34%) and "Sports" (+13%). The two providers offer similarly low prices in the “Apparel” category, where Action (Austria) is 2 percent more expensive than Temu (Switzerland).

Fig. 7: Price comparison between Action (AT) and Temu by product category (entry-level)

This price comparison was conducted between October 15 and November 15, 2024. It represents a snapshot in time, as prices change regularly at both Action and Temu. Furthermore, we considered pricing levels in this comparison. The comparison is based on entry-level pricing, i.e., the lowest listed prices for comparable items were selected for each retailer. We also looked at the mid-range price level, which lies between the lowest and highest prices for comparable products. Here, Action (Austria) turned out to be, on average, even 46 percent cheaper than Temu (Switzerland) for a comparable shopping basket (Note that the above mentioned 23 percent are for entry-level pricing).

For this comparison, a shopping basket with ten representative products was created for each category. The total prices of these baskets were compared, and the differences between Action and Temu were expressed as percentages. When selecting items, we focused on similar descriptions, appearances, functionalities, and materials. The selected items were also intended to reflect their respective categories as accurately as possible.

In addition to the significant price differences, it is noteworthy that Action offers most products at very low prices. Nearly 20 percent of the product range is available for under one euro, and nearly 80 percent for under five euros (see Question 3). Therefore, Action (Austria) proves to be a more attractive alternative to Temu (Switzerland) in terms of price.

The results of our analysis provide important insights for retail managers. First, it is surprising that Action (Austria) clearly undercuts the Chinese discount provider Temu in terms of price – even though Temu sources its products exclusively from China, benefits from numerous subsidies regarding shipping, and does not comply with all legal regulations. Second, European brick-and-mortar retailers can see that it is indeed possible to undercut Chinese competitors on price while still achieving sustainable profit margins. Third, this price comparison shows that Action can become highly attractive in Switzerland due to its extremely low prices. However, whether the product quality meets Swiss consumer expectations remains to be seen. In terms of pricing, however, these products definitely generate strong interest.

In neighboring countries, Action has generated significant interest with its low-price approach. Since entering the market in April 2025, the retailer’s attractive prices are now also available in Switzerland. To get an idea of how affordable Action is in Switzerland, the prices of 20 selected branded items were compared with their counterparts at Action in Germany.

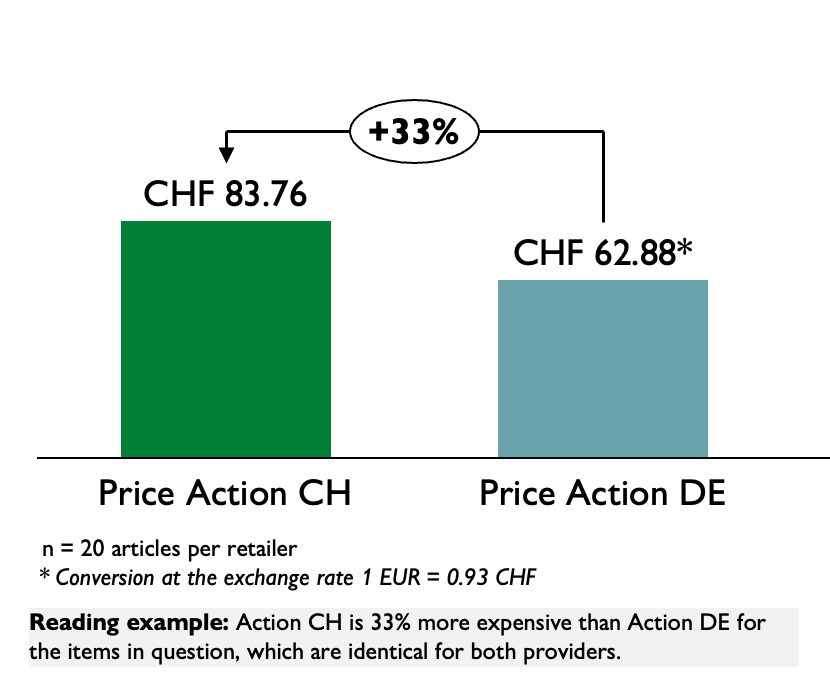

The result shows that Action in Switzerland is, on average, 33 percent more expensive than Action in Germany. As shown in Fig. 8, an identical basket of 20 branded products costs CHF 83.76 at Action in Switzerland, while the same basket costs the equivalent of CHF 62.88 at Action in Germany. For the currency conversion, an exchange rate of 1 EUR = 0.93 CHF was used.

Fig. 8: Price comparison between Action Switzerland and Action Germany for 20 selected branded products

Thus, Action remains a low-cost provider in Switzerland – but at a higher international price level. The difference compared to Germany can be attributed to factors such as higher wages, rental costs, customs duties, and Switzerland’s higher purchasing power. Compared to other local retailers, Action still positions itself as a cost-conscious alternative.

The pricing reflects data collected in April 2025 and may change. Therefore, the results of this comparison are only valid for a limited time. Prices for Action Switzerland were collected in the Bachenbülach store, while the prices for Action Germany were taken from the official website at action.com/de-de/.

7. How does Action address customer demand for sustainability and comply with related legal requirements?

Sustainable retail strategies have gained significant importance in recent years. Discount retailers are often criticized in this context. The well-known high cost pressure makes it difficult to fully comply with all legal requirements and ethical principles regarding sustainability. Action is addressing this issue. Many of the following points are taken from the company’s own reports.

Action claims that it places responsibility toward people and the environment at the center of its strategy. The Action Sustainability Programme (ASP) focuses on high product quality and sustainable practices along the value chain, and is aligned with the UN Sustainable Development Goals (SDGs) (Action, 2023).

Action aims to reduce CO₂ emissions in its own operations (Scope 1 and 2) by 60 percent by 2030 compared to 2021. By 2023, an 11 percent reduction had already been achieved, supported by LED lighting and solar panels, which cover 63 percent of the energy consumption in the distribution centers. The indirect emissions from the supply chain (Scope 3) – estimated at 5.5 million tons of CO₂ equivalents and 99 percent of the total carbon footprint in 2021 – are being reduced through the use of eco-fuel in maritime shipping. Starting in 2024, Action is aligning its targets with the Science Based Targets initiative (SBTi) (Action, 2023).

Action promotes the circular economy and launched its first circular product in 2023 – plastic baskets made from returned items. The share of recycled materials in the product range rose to 4.8 percent (Circular Transition Indicator, CTI). Packaging weight is to be reduced by 25 percent by 2025; a 20 percent reduction was already achieved in 2023. All private-label packaging is recyclable, and switching to smaller tubes for masking tape saves 140 tons of packaging material annually (Action, 2023).

Action cooperates with suppliers who comply with labor and human rights in accordance with ILO, UN, and OECD guidelines. In 2023, 2,104 supplier assessments were carried out. The company achieved 100 percent transparency for private-label and direct import products and aims to extend this to all private- and white-label products by 2025. Sustainable materials are increasingly used: 99 percent of cotton is sourced through the Better Cotton program or is organic, and 94 percent of wood is FSC®/PEFC-certified. Only Fairtrade cocoa is used (Action, 2023).

Compared to Chinese online retailers such as Shein or Temu, Action operates in a more environmentally friendly way, as its logistics are primarily regionally organized. While Chinese providers ship individual orders directly from Asia, causing high CO₂ emissions, Action relies on centralized shipments to Europe. This consolidates transport and reduces packaging use. Additionally, in-store sales at Action avoid the emission-heavy last-mile delivery. This model results in comparatively lower environmental impact (Zimmermann, 2024).

According to its own figures, Action paid around €2.2 billion in taxes in 2023 and supports social initiatives through SOS Children’s Villages, the Johan Cruyff Foundation, and the Action Scholarship Fund. In 2023, the company employed 69,040 people from 155 nations – 72 percent of them women – created 8,988 new jobs, and promoted 2,742 employees. Training programs averaging 2.5 hours per employee support diversity, equity, and inclusion (Action, 2023).

Action adheres to strict governance and a comprehensive framework for human rights and environmental due diligence (HREDD). This includes anti-corruption measures, occupational safety, data protection, and the Code of Conduct, and ensures compliance with Germany’s Supply Chain Act and the EU’s Corporate Sustainability Due Diligence Directive (CSDDD). Long-term partnerships with suppliers support the goal of a sustainable supply chain. Action sources 49 percent of its products from China, 6 percent from other Asian countries, and 45 percent from Europe, promoting "proximity sourcing" near retail locations (Action, 2023).

Action pursues a holistic sustainability strategy that integrates environmental, social, and governance aspects. In 2023, Action conducted a double materiality assessment in accordance with the Corporate Sustainability Reporting Directive (CSRD) and is preparing to comply with the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) to meet increasing demands for social and environmental responsibility (Action, 2023).

Deloitte Schweiz. (2024). Schweizer Bevölkerung fordert verstärktes Engagement von Unternehmen, Staat und Konsumenten für mehr Nachhaltigkeit. https://www2.deloitte.com/ch/de/pages/press-releases/articles/swiss-public-calls-on-companies-the-state-and-consumers-to-work-harder-to-improve-sustainability.html

Freundt, T., Lehmann, S., Grossmann, C., & Staack, Y. (2024). Grün um jeden Preis. https://www.mckinsey.com/de/branchen/konsumguter-handel/akzente/akzente-2-2024/2024-2-gruen-um-jeden-preis

Zimmermann, R. (2024). Action: Discounter sind okay, Chinas Onlinehändler weniger. https://www.tagesanzeiger.ch/action-discounter-sind-okay-chinas-onlinehaendler-weniger-855899301886

8. What criticisms have been raised in the press about Action, and what are the main concerns?

Action has rapidly developed into one of the most successful discount retailers in all of Europe. The secret to its success lies primarily in its unbeatable low prices, which few other retailers can match. With a broad product range – from household goods and decorations to cosmetics – Action attracts millions of price-conscious customers. However, the extremely low prices also raise questions and lead to critical discussions. Topics such as sustainability and quality are repeatedly brought into focus. These challenges deserve closer examination.

Action advertises offering good quality at the lowest prices. In an interview with the magazine Galileo in July 2024, Heiko Großner, Action’s Head of Germany, and Peter Apelman, Action’s Chief Purchasing Officer, stated that quality is a high priority for the company (Galileo, 2024). They reported that Action complies with 250 quality standards, even for the approximately 60 percent of products manufactured in Asia. Additionally, they said that EU and country-specific regulations are taken into account. However, a look at Trustpilot paints a different picture: on October 23, 2024, Action had 1,112 reviews with an average rating of 1.8 out of a maximum of 5 stars (Trustpilot, 2024). Trustpilot is an online platform where consumers rate their experiences with companies to assist others in their purchasing decisions. Seventy-three percent of Action’s reviews received only one star. Customers complain about poor quality, product defects, and misleading product descriptions.

Trustpilot ratings, however, should be interpreted with caution. Coop, for example, also had an average rating of 1.8 stars from 415 reviews. Migros scored even lower, with an average of 1.6 stars from 575 reviews.

According to a report in Tages-Anzeiger (2024), quality appears to be of secondary importance to Action, based on the assumption that customers don’t care whether a product lasts one month or one year. These potential quality issues raise concerns among experts that Action may not be well received by Swiss consumers. Studies show that Swiss consumers are significantly more quality-conscious compared to those in other countries (Watson, 2024). If a customer has a bad experience with a product, they won’t return. Swiss consumers prefer high-quality products, often associated with the "Swiss Quality" label (Tages-Anzeiger, 2024). Discounters like Aldi and Lidl adapted their product ranges to local preferences when entering the Swiss market (Tages-Anzeiger, 2024).

The second major criticism concerns sustainability. On its website, Action promotes sustainability themes such as the use of "Better Cotton", a circular economy, sustainably sourced paper and wood, and Fairtrade chocolate (Action, 2024). In the aforementioned interview, Heiko Großner and Peter Apelman emphasized that Action has long attached great importance to complying with and even exceeding environmental standards (Galileo, 2024). Critics, however, express doubts and accuse the company of greenwashing – a practice in which exaggerated or misleading environmental claims are used to create a sustainable image without taking meaningful action. An economic expert from Greenpeace points out that truly sustainable products are not possible at Action’s low prices (Galileo, 2024). Many of the certifications and labels used are issued by the industry itself and are often just pleasant-sounding promises. Furthermore, the standards – if they are adhered to at all – are very low, with no clear regulations for the use of insecticides or water management.

Action. (2024). Nachhaltigkeit. https://www.action.com/de-ch/nachhaltigkeit/

Galileo. (2024, Juli 15). "Wir haben immer den günstigsten Preis!" Welche Strategie verfolgt die Discounter-Kette "Action"? https://www.youtube.com/watch? v=egbncZoZ0Ok

NZZ. (2024, April 10). Der Discounter Action erobert Europa im Sturm – funktioniert sein Er-folgskonzept auch in der Schweiz? https://www.nzz.ch/wirtschaft /action-der-discounter-erobert-europa-und-auch-die-schweiz-ld.1824145

Tages-Anzeiger. (2024, März 6). Hier plant Billigkette Action ihre ersten Schweizer Filialen. https://www.tagesanzeiger.ch/discounter-action-das-sind-die-ersten-schweizer-filialen-154062266995

Trustpilot. (2024). Action. https://ch.trustpilot.com/review/action.com

Watson. (2024, Oktober 14). «Action ist unterste Preislage. Tiefer geht’s nicht mehr» - Experte über neuen Discounter. https://www.watson.ch/schweiz/international/660140427-action-in-der-schweiz-das-bedeutet-der-neue-discounter-fuer-kunden

9. How difficult is it for Action to open locations in Switzerland, and how many are planned?

On September 16, 2024, Action posted a job opening for a store manager position in Bachenbülach (ZH) on Alpha.ch. Since early November 2024, interested candidates can also apply for this position via LinkedIn. This suggests that the negotiations between Action and the Parkallee Bachenbülach shopping center, which took place at the beginning of 2024, were successful (Tages-Anzeiger, 2024). Industry experts estimate, however, that the store will open in 2025 (NZZ, 2024). According to several sources, the next planned locations include the Les Galeries du Rex shopping center in Fribourg and Martigny (VS) (Tages-Anzeiger, 2024; Konsider, 2024). These stores are also expected to open in 2025 (Tages-Anzeiger, 2024). For site selection and negotiations, Action hired the former head of real estate at Denner (Konsider, 2024).

Since early November, Action has also been looking for a project manager in the area of Retail Construction for the Basel region. The job description includes responsibilities such as the overall planning of store – from acquisition to launch – and cost estimation. This further indicates that Action is planning a rapid expansion throughout Switzerland.

But how easy will it be for Action to open more stores in Switzerland? One challenge is that Action focuses on locations with low rental costs. In Switzerland, rental prices are significantly higher than in Austria or Germany. For a discounter that operates with ultra-low prices, it will likely be difficult to find suitable locations that ultimately generate profit (Watson, 2024), especially considering Action’s average store size of 1,000 square meters (NZZ, 2024). According to insights from retail practice, such spaces are currently readily available in Switzerland. Action will primarily aim to rent existing premises rather than develop new ones. The investment in new developments would be too high and time-consuming.

Even in the unlikely event that new sites are developed, the current legal framework is relatively favorable. With store sizes between 800 and 1,500 square meters, Action remains below the thresholds of the Environmental Protection Act (Rudolph & Schweizer, 2006). For stores of this size, zoning plans or environmental impact assessments are rarely required (Rudolph & Schweizer, 2006). For example, retailers in the canton of Basel-Land are exempt from submitting district development plans if the store area is below 1,000 square meters (gfvbl, 2021).

As a result, additional regulations concerning development and infrastructure (such as roads, utilities, public spaces, or noise protection) and their financing are not applicable (City of Zurich, 2024). In summary, the absence of requirements for environmental impact assessments, zoning, and district planning means that Action could open new locations quickly.

However, the focus remains on renting existing spaces. While closures or the sale of Melectronics, SportX, and other specialty formats in Migros centers are freeing up retail space, Migros will carefully evaluate whether to lease these to Action, as this could result in revenue competition (NZZ, 2024). However, since Action often opens stores outside city centers, it does not necessarily have to rely on Migros spaces.

Gemeindefachverband BL. (2021). Raumplanungs- und Baurecht. https://www.gfvbl.ch/public/upload/assets/1181/RAUMPLANUNGS-%20% 20BAURECHT_2021.pdf?fp=3

Konsider. (2024). Action will nach Bachenbülach, Freiburg, Martigny. https://www.konsider.ch/bericht-action-will-nach-bachenbuelach,-freiburg,-martigny-20240306

NZZ. (2024, April 10). Der Discounter Action erobert Europa im Sturm. https://www.nzz.ch/

wirtschaft/action-der-discounter-erobert-europa-und-auch-die-schweiz-ld.1824145

Rudolph, T. & Schweizer, M. (2006). Das Discount-Phänomen – Eine 360-Grad Betrachtung. Verlag Neue Zürcher Zeitung.

Stadt Zürich. (2024). Quartierpläne. https://www.stadt-zuerich.ch/hbd/de/index/

staedtebau/planung/quartierplan.html

Tages-Anzeiger. (2024). Hier plant die Billigkette Action ihre ersten Schweizer Filialen. https:\\www.tagesanzeiger.ch\\discounter-action-das-sind-die-ersten-schweizer-filialen-154062266995"

Watson. (2024). «Action ist unterste Preislage. Tiefer geht’s nicht mehr». https://www.watson.ch/schweiz/ international/660140427-action-in-der-schweiz-das-bedeutet-der-neue-discounter-fuer-kunden

10. What are Action’s stores like, and what differences can be observed between them?

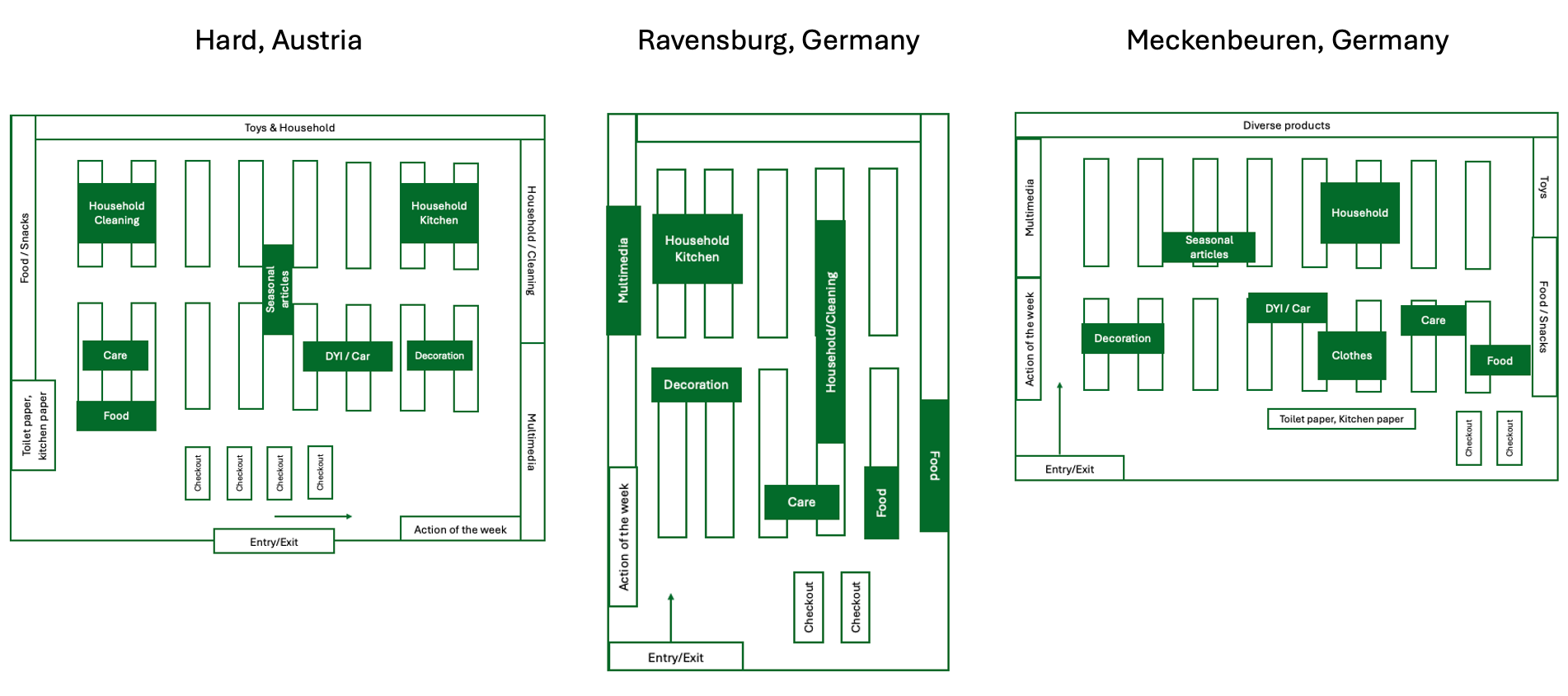

We visited five locations to gain a better understanding of Action: Offenbach, Frankfurt Nordwestzentrum, Ravensburg, and Meckenbeuren in Germany, as well as Hard in Austria. The following insights were gathered.

Action stores are predominantly located outside city centers, often in industrial or commercial areas. While the stores in Ravensburg and Hard are housed in modern buildings, the store in Meckenbeuren is located in an older structure. However, all locations had sufficient parking facilities, which is an essential requirement for accessibility due to the peripheral location of the stores.

Upon entering the stores, it was observed that the layout covers approximately 800 square meters, though this varies slightly. Still, some consistent elements were identified across all three stores: Products from the "Food & Drinks" category were always located near the checkout area, while promotional items under the title "Action of the Week" were positioned at the entrance (see Fig. 8).

All visited Action stores were heavily frequented, regardless of the time of day.

Shelf observations revealed clear differences in condition depending on the product category. In particular, the clothing section stood out for its disorganized state, amplified by a high volume of items and returned products. Some shelves contained items that had been returned without any order, and occasionally opened packaging was observed. Shelf gaps were also frequently noticeable. Especially in the Hard store, several shelves were not restocked, and boxes with goods were left in the aisles while staff worked on unpacking them.

Conversations with employees revealed complaints about staff shortages. According to the staff, this is generally due to lower wages compared to Aldi and Lidl, as well as constant stress. Because of the limited number of staff, only one checkout counter was often in operation.

In summary, the Action stores show organizational shortcomings, visible in empty shelves, unpacked boxes in aisles, and a hectic work environment for staff. As a discounter, Action prioritizes low prices, which sometimes leads to a neglect of tidiness and fully stocked shelves. This strategic approach enables an exceptionally low-cost shopping experience. Despite these limitations, the stores enjoy high customer traffic and popularity.

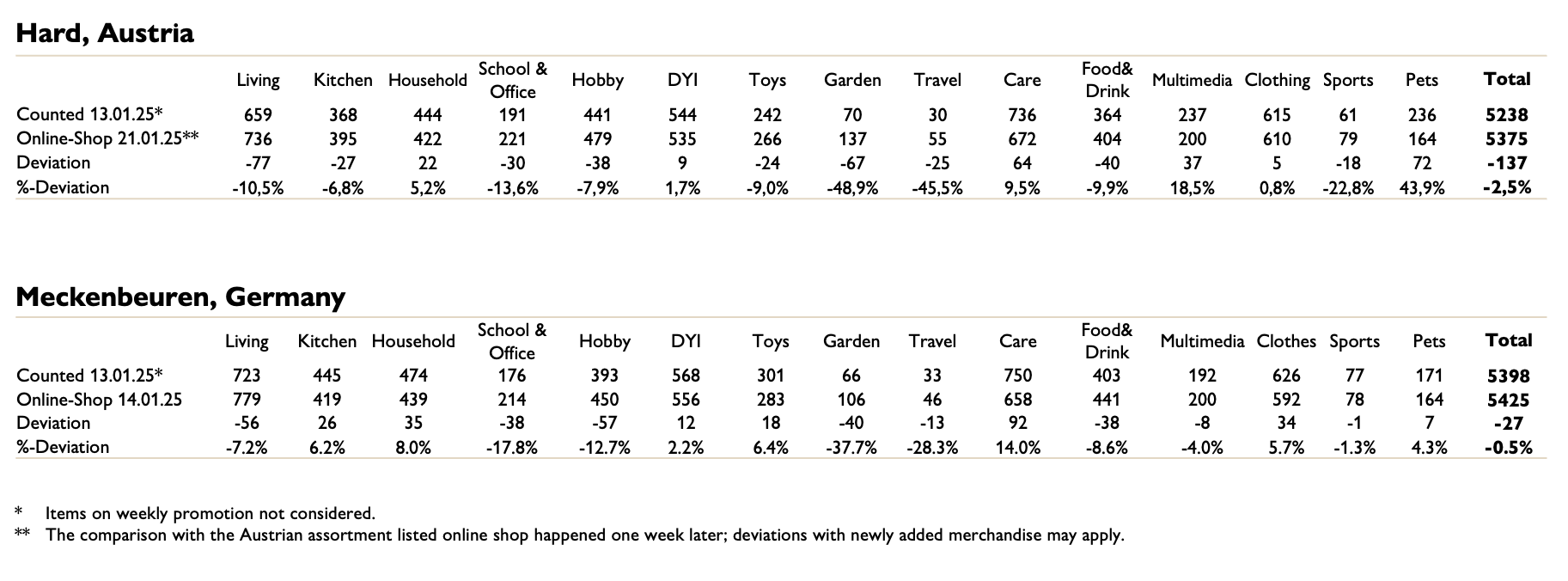

The comparison of the online and offline product range was carried out using the two stores in Meckenbeuren (Germany) and Hard (Austria) (see Fig. 9). All shelves in each store were photographed using a smartphone on January 13, 2025. The resulting images were then systematically analyzed on January 14, 2025 in three steps:

1. First, we sorted the photos according to the 15 product categories listed in the Action online shop.

2. Then, we manually counted the price tags visible in the images for individual products.

3. Finally, we compared the resulting numbers per product category with the item count in the Action online shop, calculating both the absolute and relative deviation.

Further information and images of the reviewed product categories are available upon request.

The percentage deviation across all product categories for the Meckenbeuren and Hard stores compared to the online shop was -0.5% and -2.5%, respectively. With a total of 5,425 and 5,375 items listed online, these deviations suggest that the in-store assortment largely matches the online assortment. The comparison between the two stores also indicates a 95% overlap in the number of counted items, suggesting a nearly standardized product range (see Fig. 9).

Fig. 9: Comparison of Online and Offline Product Range at Action Stores in Hard and Meckenbeuren

It is worth noting that significant deviations were particularly observed in the categories "Garden" and "Travel" at both locations. These discrepancies may be partly due to limitations of the comparison itself. On one hand, the analysis took place on a Monday, meaning new weekly merchandise may not yet have been fully stocked on store shelves. The shelf gaps observed in the Hard store support this assumption. Additionally, manual counting based on images presents a certain margin of error that must be taken into account.

Want to stay informed about upcoming trend reports?

Sign up for our newsletter and receive monthly updates

with key insights from the Institute of Retail Management.

Kontakt

-

Universität St.GallenInstitut für Handelsmanagement (IRM-HSG)Gottlieb Duttweiler LehrstuhlDufourstrasse 40aCH-9000 St.Gallen

-

redx-irm@unisg.ch

-

+41 71 224 28 56