Hardly any other company has attracted as much media attention in recent months as the up-and-coming Chinese e-commerce platform Temu. The Institute of Retail Management at the University of St.Gallen (IRM-HSG) has also received many enquiries in recent weeks, which we would like to answer with this trend report. In compact form, you will find answers to the most pressing questions about Temu. These questions result from the survey of retail companies at the beginning of August 2024.

This trend report provides a well-founded answer to each of these top 10 questions. We have used recognised sources and always endeavoured to provide a balanced and neutral answer. This trend report thus fulfils an information function with the aim of providing companies, educational institutions, the media and other interested parties with fact-based information about this company. In addition to this compact overview, we offer in-depth links for each question, which provide additional information. Some of these links are video references, studies, newspaper articles, etc. Click on a question and benefit from the initially compact answer, but also from the in-depth information.

Last updated: September 2025

Trend Report: Temu

1. How is Temu's business model structured and how does it differ from well-known platforms such as Amazon?

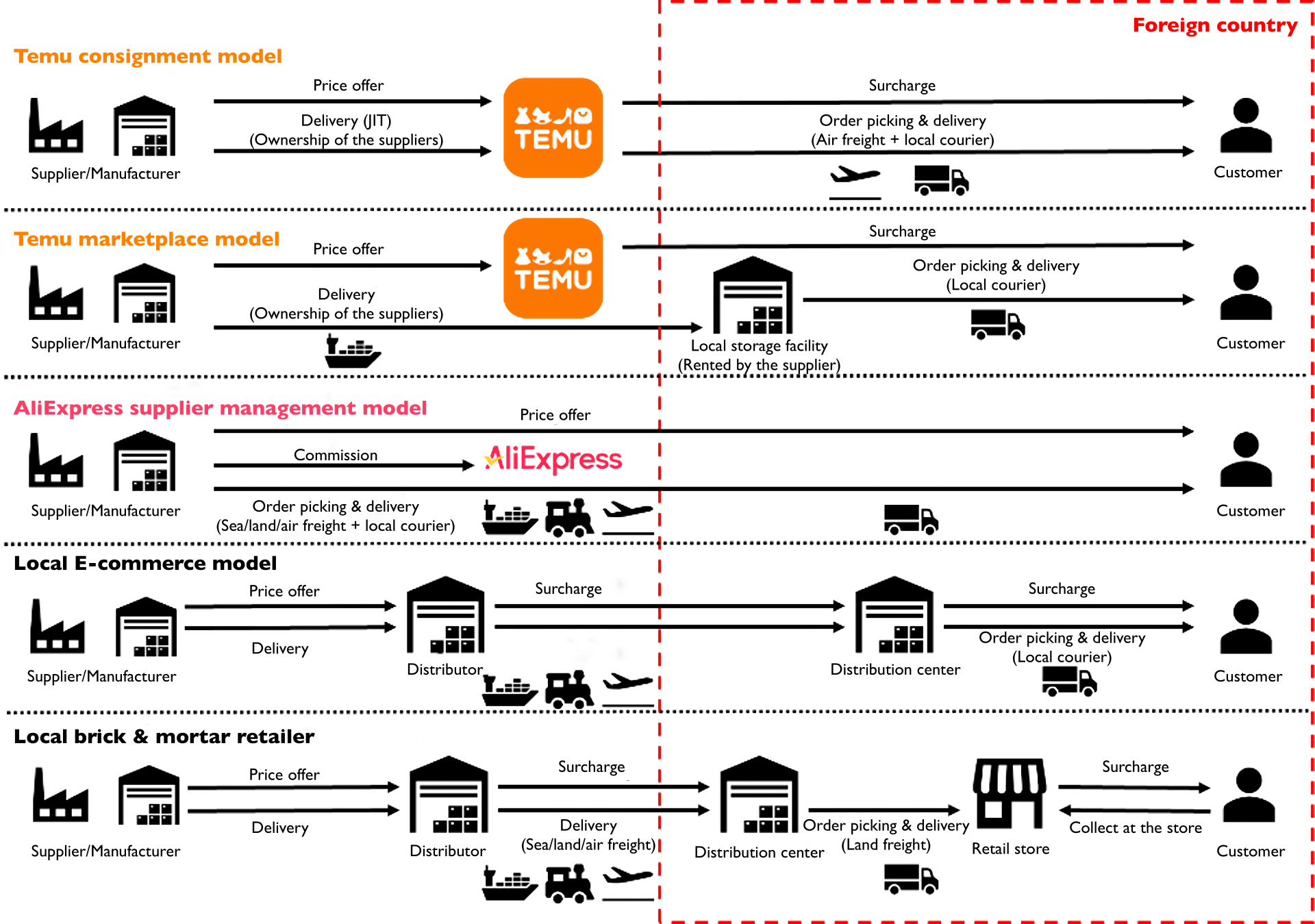

At the heart of Temu's business model is direct collaboration with an extensive network of manufacturers, without any middlemen. Production mainly takes place in China. Since July 2024, Temu has also been opening up to European manufacturers in order to reduce delivery times and offer European customers a better shopping experience (Schwarz, 2024). As soon as a product is ordered, Temu immediately forwards it to the manufacturer, who can then optimally track demand for their individual items. Through this direct cooperation, Temu bypasses the margin of middlemen, so that only the costs for the much cheaper Chinese products are incurred. This significantly reduces product prices and enables Temu to offer products at prices well below the European market level. These price advantages are passed on directly to customers, which makes Temu particularly attractive and constitutes its main competitive advantage.

Another key component of the business model is logistics. Temu operates a centralised fulfilment system that ensures consistent delivery times of no more than 14 days worldwide. This means that, unlike Amazon or AliExpress, Temu handles shipping exclusively itself and does not allow direct shipping by manufacturers.

Temu is now driving its European expansion with the so-called 'Local-to-Local model'. By involving local merchants more closely and relying on regional warehouses, delivery times can be further reduced (DHL, 2025). The company aims to generate up to 80% of its European revenue through this approach in the future (Günter, 2025; SRF, 2025). In April 2025, Temu and DHL deepened their cooperation to boost efficiency (Retail News, 2025). On 15 September 2025, Temu launched the 'Local-to-Local model' in Switzerland (SRF, 2025). For now, Swiss businesses can offer their products on Temu only within Switzerland, though an expansion is planned (SRF, 2025). These sellers must manage their own logistics and comply with Temu’s pricing requirements. This has raised concerns from the Swiss Retail Federation regarding pricing and data protection (Janssen, 2025). The national trade association has also warned that the risks may outweigh the benefits. In particular, reputational risks and Temu’s strict conditions should not be underestimated: prices, for instance, must be set 15% lower than Amazon’s (Watson, 2025).

In addition to local warehouses, Temu is currently testing another source of income, namely retail media. Retailers are offered advertising space so that they can place their products more prominently. With these approaches, Temu is thus also launching the next stage of expansion in Europe (Günter, 2025).

With the help of gamification elements, Temu succeeds in generating additional purchases. The platform integrates various elements that make shopping almost playful. This includes features such as social referrals and gambling-like mechanisms that encourage users to make additional purchases or reach certain shopping cart values. These gamification elements promote customer loyalty and increase the likelihood that users will shop on the platform repeatedly. However, this was banned in Switzerland in April 2025.

From the customer's point of view, Temu differs from Amazon in that it offers lower prices. By focusing on direct cooperation with significantly cheaper Chinese manufacturers, Temu manages to offer consistent quality and acceptable delivery times. Unlike Amazon, Temu does not operate its own retail business but acts solely as a marketplace. However, Amazon has now launched its new Amazon Haul store in the US, which is very similar to Temu in many respects (Palmer, 2025). Due to the increase in customs duties in the US, Amazon Haul is now adapting its business model so that it is not solely dependent on cheap Chinese goods (Sato, 2025). At the beginning of May, Amazon Haul will launch its beta version in the United Kingdom, marking its first foray into Europe (Redaktion LZ, 2025). This June Amazon Haul started in Germany (Kälin, 2025).

Unlike Temu, AliExpress allows its customers to contact manufacturers directly, which can lead to price negotiations and thus even better final prices for consumers. However, AliExpress's delivery times are significantly longer than Temu's: standard shipping takes 15-35 working days. Premium shipping is only available at an additional cost, which reduces the delivery time to Temu's standard delivery time (Alibaba.com, 2024).

Temu follows the approach of a global discounter. Its cost leadership is guaranteed by Chinese low-price producers, a highly efficient supply chain and very active price management, which clearly sets the marketplace apart from established market leaders such as Amazon and AliExpress in terms of price attractiveness.

- Article: Amazon vs. Temu: Business Modle & Logistics

- Article: Temu vs. AliExpress Reviewed 2024

- Article: How Does Temu Make Money? Dissecting its Business Model (2024)

- Article: How SHEIN and Temu Conquered Fast Fashion - and Forged a New Business Modell

- Video: The Most Evil Company That Took Over the USA

- Article: Temu hat alles zerstört

References

Günter, M. (2025, January 16). Temu setzt auf Wachstum mit lokalen Händlern - und testet Retail Media. Retail News.

https://retail-news.de/temu-lokale-haendler-retail-media-europa/

Janssen, J. (2025, January 18). Temu will jetzt auch Schweizer Händler auf seiner Plattform. 20minuten.

https://www.20min.ch/story/gigant-aus-china-temu-will-jetzt-auch-schweizer-haendler-auf-ihrer-plattform-103260288

Kälin, M. (2025, June 9). Wann kommt neuer Webshop Amazon Haul in die Schweiz? Blick.

https://www.blick.ch/wirtschaft/mit-krass-guenstigen-preisen-wie-temu-und-co-wann-kommt-neuer-webshop-amazon-haul-in-die-schweiz-id20945727.html

Mayple. (2023). Amazon Vendor vs. Seller: The Difference + Pros & Cons for 2024. Mayple.

https://www.mayple.com

Palmer, A. (2025, February 28). Amazon eyes global expansion for its Temu, Shein competitor. CNBC.

https://www.cnbc.com/2025/02/28/amazon-eyes-global-expansion-for-its-temu-shein-competitor.html

Redaktion LZ. (2025, May 7). Amazons Billigplattform Haul startet in Europa. Lebensmittel Zeitung.

https://www.lebensmittelzeitung.net/handel/online-handel/konkurrenz-fuer-temu--co.-amazons-billigplattform-haul-startet-in-europa-184147

Retail News. (2025, April 6). Weitere Expansion: DHL und Temu bauen Kooperation für lokale Händler aus. Retail News.

https://retail-news.de/dhl-temu-neue-kooperation-expansion-kmu/

Sato, M. (2025, April 8). Amazon is already changing its ultra-cheap Temu copycat. The Verge.

https://www.theverge.com/news/645465/amazon-haul-temu-ultra-cheap-tariffs-trump

Schwarz, F. (2024, August 22). Kürzere Lieferzeiten: Temu greift Amazon in Europa an. Frankfurter Allgemeine Zeitung. https://www.faz.net/aktuell/wirtschaft/unternehmen/temu-greift-amazon-in-europa-an-19936681.html

SRF. (2025, September 15). Temu hat sein "Local-to-Local"-Programm in der Schweiz lanciert. https://www.srf.ch/news/wirtschaft/e-commerce-temu-hat-sein-local-to-local-programm-in-der-schweiz-lanciert

Watson. (2025, March 13). Temu lockt Schweizer Einzelhändler - Handelsverband warnt.

https://www.watson.ch/schweiz/wirtschaft/124333735-temu-offensive-in-der-schweiz-handelsverband-warnt-einzelhaendler

Weidemann, T. (2024, November 15). Amazon Haul kopiert chinesische Billigshops – will aber eine Sache besser machen. Digital pioneers. https://t3n.de/news/amazon-haul-temu-china-shops-1657852/

2. How big is Temu and is the company successful?

Here are the figures for PDD Holdings' revenue and profit between 2021 and 2024:

- 2021: Revenue of USD 14.7 billion and profit of USD 1.2 billion

- 2022: Revenue of USD 18.9 billion and profit of USD 4.6 billion

- 2023: Revenue of USD 34.9 billion and profit of USD 8.5 billion

- 2024: Profit of USD 3.9 billion in the first quarter (229% increase year-on-year compared to the same period in 2023) and revenue of USD 12 billion

- 2024: Profit of USD 4.4 billion in the second quarter (144% increase year-on-year compared to the same period in 2023) and revenue of USD 13.4 billion

- 2024: Third-quarter revenue of $14.2 billion

- 2024: Fourth-quarter revenue of $15.2 billion and profit of $3.5 billion

In 2024, PDD achieved revenue growth of almost 60% with a total profit of €14 billion (Retail News, 2025a).

- 2022: Estimated sales of USD 0.3 billion

- 2023: Estimated sales of USD 13.8 billion

- 2024 (forecast): Expected sales of USD 29.5 billion (WeThrift, 2024)

Although Temu was only founded in September 2022, it has experienced remarkable growth in a very short period of time.

-

Article: Zukünftige Entwicklungen von PDD

Curry, D. (2024, November 4). Temu Revenue and Usage Statistics (2024). Business of Apps.

https://www.businessofapps.com/data/temu-statistics/

Hochman, S. (2024, September 3). Learning from Temu’s Marketplace Crash. Zero100.

Koutsou-Wehling, N. (2024, October 15). Temu Revenue: Does Temu Really Lose US$30 per Order?. ECDB.

https://excitingcommerce.de/2024/12/04/temu-und-shein-mit-nutzerzahlen-fuer-deutschland-und-europa/

Liu, T. W. (2023, May 26). Temu Is Losing Millions of Dollars to Send You Cheap Socks. Wired.

https://www.wired.com/story/temu-is-losing-millions-of-dollars-to-send-you-cheap-socks/

Macrotrends (2024). PDD Holdings Net Income 2018-2024 / PDD.

https://www.macrotrends.net/stocks/charts/PDD/pdd-holdings/net-income

Morant, D. (2025, April 20). Temu, Shein und Aliexpress entziehen über halbe Milliarde dem Schweizer Kleiderhandel. Carpathia.

https://blog.carpathia.ch/2025/04/20/temu-shein-und-aliexpress-entziehen-ueber-halbe-milliarde-dem-schweizer-kleiderhandel/

PDD Holdings (2024). Annual Reports.

https://investor.pddholdings.com/financial-information/annual-reports/

PDD Holdings (2025, March 20). News Release. PDD Holdings Announces Forth Quarter 2024 and Fiscal Year 2024 Unaudited Financial Results.

https://investor.pddholdings.com/news-releases/news-release-details/pdd-holdings-announces-fourth-quarter-2024-and-fiscal-year-2024

Poinski, M. (2024, February 21). Why Temu Is Spending On Marketing Like A Billion-aire. Forbes.

Pöschl, F. (2025, January 28). Temu schiesst ein Jahr nach Marktstart an die Spitze der Schweiz. 20 Minuten.

https://www.20min.ch/story/temu-schiesst-ein-jahr-nach-marktstarkt-an-die-spitze-der-schweiz-103268657

Retail News. (2025a, March 20). Temu-Mutter PDD: Fast 60% Umsatzwachstum bei 14 Milliarden Euro Gewinn in 2024.

https://retail-news.de/pdd-holdings-temu-umsatz-q4-2024/

Retail News. (2025b, March 27). Bestenliste: Temu zählt zu den "besten Online-Shops" der USA 2025.

https://retail-news.de/temu-usa-best-stores-2025/

Rönisch, S. (2025, Janauar 17). 545 Millionen Downloads: Temu ist die meistgeladene Shopping-App der Welt. iBusiness.

https://www.ibusiness.de/aktuell/db/113734SUR.html

Sherriff, S. (2024, January 23). Data: Temu ad spend jumped 1000% year-on-year in 2023. Marketing Beat.

Statista. (2025, March 26). Umsatz der PDD Holdings weltweit vom 2. Quartal 2018 bis zum 4. Quartal 2024.

https://de.statista.com/statistik/daten/studie/1042364/umfrage/quartalsumsatz-von-pinduoduo/

Tai, C. (2023, October 26). Chinese e-commerce giants Temu and Shein compete head-to-head in global expansion. JingDaily. https://jingdaily.com/posts/temu-shein-south-america-expansion

Tech Buzz China. (2023). Temu profitability. Six Degress Intelligence Expert Interviews. ChinaTalk.

www.chinatalk.nl

Watson, (2025, March 14). Temu lockt Schweizer Einzelhändler - Handelsverband warnt. Watson.

https://www.watson.ch/schweiz/wirtschaft/124333735-temu-offensive-in-der-schweiz-handelsverband-warnt-einzelhaendler

Weidemann, T. (2025, January 23). Der Siegeszug der China-Plattform: Temu zieht erstmals an Amazon vorbei. t3n.

https://t3n.de/news/temu-vor-amazon-1669580/

Wethrift (2024). Temu Statistics 2024: Revenue, Valuation, Growth & Profit.

https://www.wethrift.com/p/temu-statistics/

3. Is Temu only popular among young people?

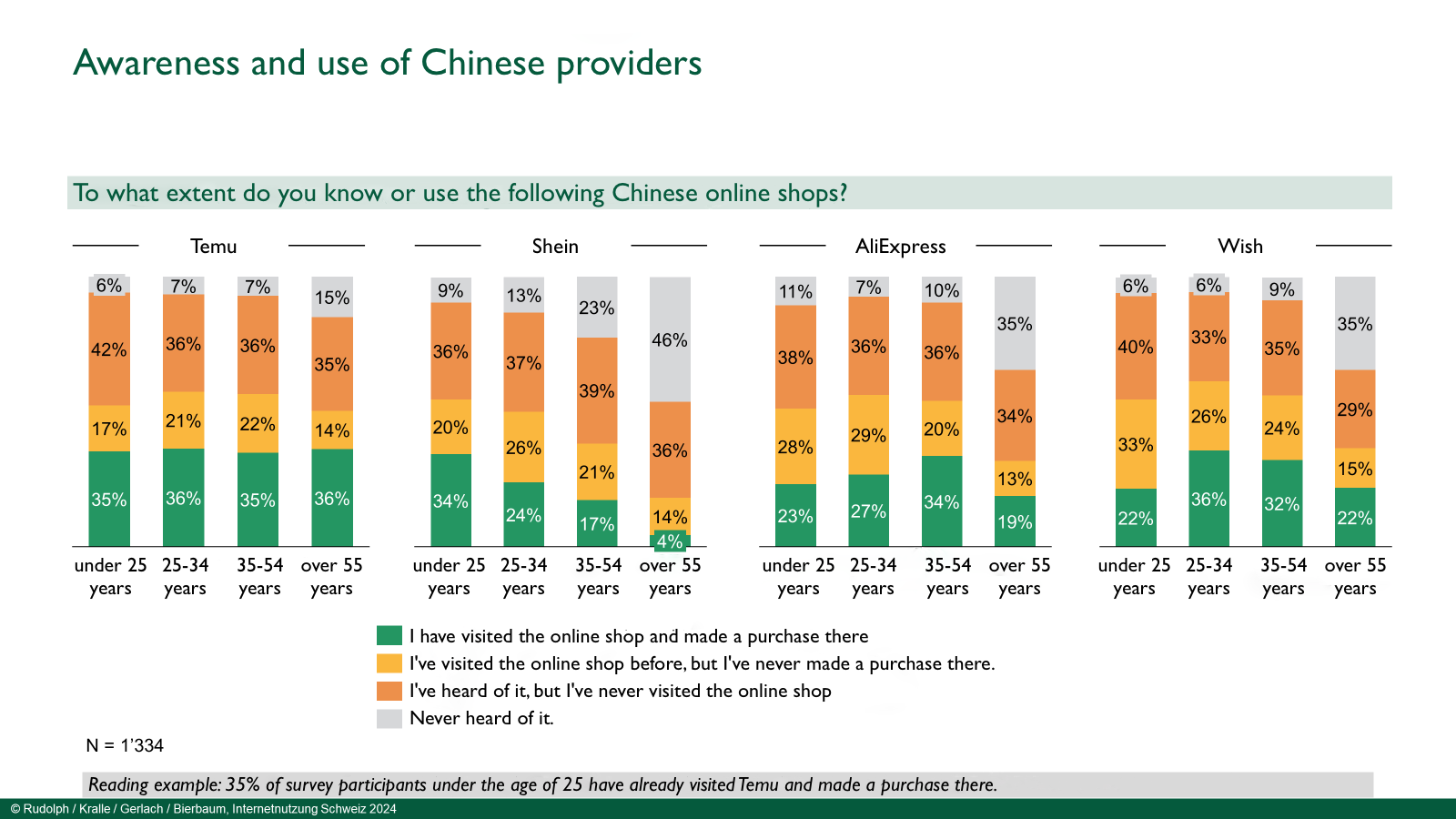

It is often claimed that, due to low prices and supposedly lower quality, Temu mainly attracts young people with small budgets and a high affinity for online shopping. However, our study, which we conducted in September 2024 as part of a long-term investigation into internet usage in Switzerland, paints a different picture. In a representative survey of over 1,300 participants from Switzerland, it was found that more than a third of respondents in every age group had already shopped at Temu. Figure 1 also shows that Temu is the only Chinese provider that is equally popular among all age groups. For this reason, it is a false assumption that only young people with low incomes order from Temu.

- Article: Warum Gen X und Boomer Temu so lieben

- Article: Temu Besucher (nach Alter)

4. What competitive advantages does Temu have over local retailers and which sectors compete most strongly with Temu?

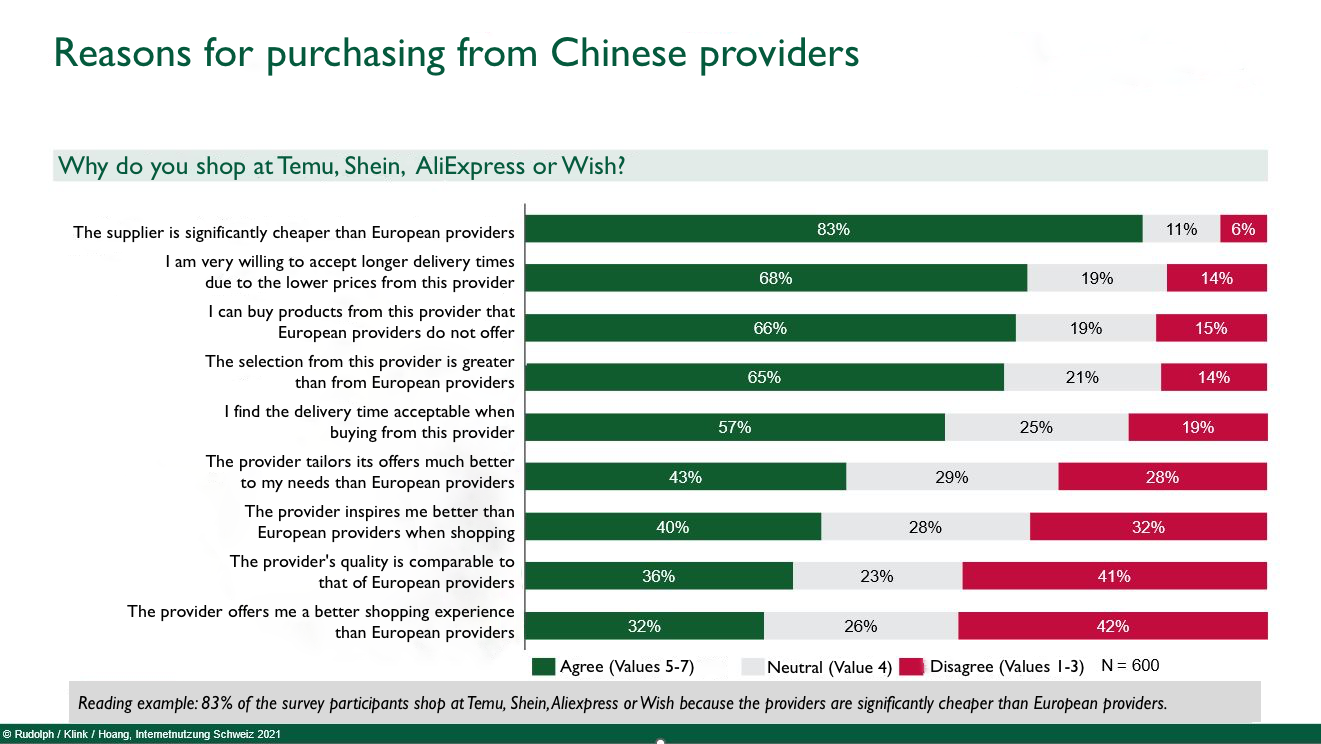

In our study on internet usage in Switzerland, we surveyed over 1,300 Swiss people about their reasons for shopping with Chinese providers. These included Temu. The following chart in Figure 2 shows the advantage enjoyed by Chinese providers. Their competitive edge lies primarily in their prices.

The Temu app works like a casino, constantly enticing customers with offers and discounts. In addition, Temu's algorithm is extremely precise in tailoring itself to each customer's individual preferences, resulting in a personalised and inspiring shopping experience. The Temu app features a wheel of fortune that can be spun to win discounts. These can be increased with additional mini-games. Furthermore, a stopwatch runs, in which a customer must spend a certain amount within the specified time to receive these prizes. After a purchase, the customer continues to collect points, which lead to more discounts, and often the purchase is used as free credit for the next purchase if it happens in the next few days.

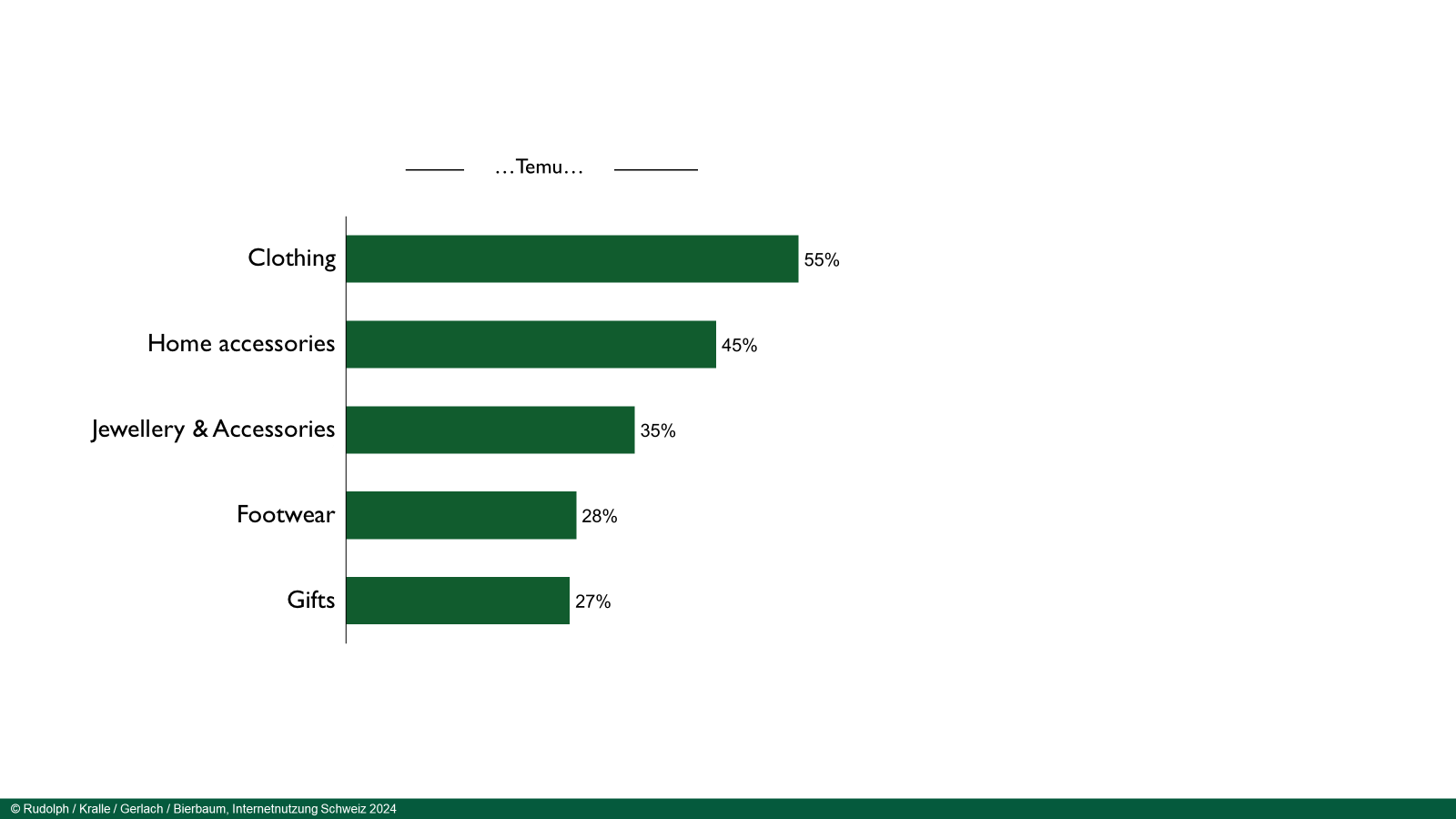

According to the responses from over 1,300 consumers surveyed, they purchase the following product categories from Temu:

Swiss retailers are also feeling the impact of these figures and the associated purchasing behaviour of the population. Bernhard Egger, managing director of the trade association, recently commented on this. According to him, Chinese suppliers such as Temu are expected to cause losses of around one to three billion Swiss francs per year in Swiss retail. However, he explains that those who sell cheap clothing are particularly affected, while companies in the higher-priced segment with better quality face less competition (awp Finanznachrichten, 2024).

Online shopping grew by 18% in 2024 compared to the previous year. At CHF 2.6 billion, this is a new record result. The main drivers are small parcels from Asia, which also include Temu (Handelsverband.swiss, 2025). Although these are mostly small amounts, the total is more than 10 million parcels (Bachmann, 2025).

Even major discount campaigns in Switzerland, such as Black Friday, are losing their appeal, as providers such as Temu make the discount prices of Swiss retailers seem high in comparison. More than 40% are no longer interested in Black Friday, as Temu attracts customers with better offers all year round (Spiegel Wirtschaft, 2024). In addition, Temu engages in so-called ‘keyword bidding’ on other brands. This involves bidding money on certain search terms and keywords in search engines to increase their presence in online advertising. Temu also bids on third-party brand keywords such as ‘Zara Jeans’, ‘Mango Dresses’ or ‘Walmart Black Friday Deals’. They choose this strategy because search engines are central to bargain hunting. As a result, the cost per click has increased 16-fold in the last two years (Grunow, 2024).

Not only Swiss companies, but also online giants such as Amazon have to respond to Temu. On 13 November, Amazon unveiled its new shop, Amazon Haul, in the United States. There, goods are sold for less than USD 20 and delivered within two weeks. The app is similar in design to Temu, and the whole concept is strongly reminiscent of the Chinese company. However, Amazon wants to check the safety of the retailers' products (Weidemann, 2024). This concept is now set to come to Europe in the course of the year (Palmer, 2025). Initial tests are already being carried out in Europe (Redaktion LZ, 2025).

Amazon is also asking retailers who sell on Temu and Amazon not to offer their goods at lower prices on Temu. Retailers who disregard this new rule will be excluded from the Featured Offer programme. This programme makes shopping easier for customers. Amazon wants to ensure that customers always get the best price (Von Thun, 2025).

The German company Kaufland also wants to become a European alternative to Temu. It plans to expand its online marketplace to Italy and France in order to compete with Temu. The advantage here is that, unlike its competitors, customer and retailer data is stored exclusively in Europe (Kolf, 2025).

Bachmann, D. (2025, March 13). Der Temu-Effekt: Schweizer Detailhändler geraten immer stärker unter Druck. NZZ.

https://www.nzz.ch/wirtschaft/der-temu-effekt-jetzt-zeigt-sich-wie-viel-die-schweizer-online-in-china-kaufen-ld.1875133

Grunow, P. (2024, November 27). Temu vs. Shein: Der Kampf um den Black-Friday Online-Handel! wallstreet online.

https://www.wallstreet-online.de/nachricht/18761547-marketingschlacht-temu-vs-shein-kampf-black-friday-online-handel

Handelsverband.swiss (2025, March 13). Schweizer Online-Konsum wächst im Jahr 2024 erneut um 3.5 Prozent - Grösste Gewinner CH-Marktplätze.

https://handelsverband.swiss/news/schweizer-online-konsum-waechst-im-jahr-2024-erneut-um-3-5-prozent-groesste-gewinner-ch-marktplaetze/

Kolf, F. (2025, April 11). Kaufland will europäische Alternative zu Amazon und Temu werden. Handelsblatt.

https://www.handelsblatt.com/unternehmen/handel-konsumgueter/kaufland-will-europaeische-alternative-zu-amazon-und-temu-werden/100119703.html

Palmer, A. (2025, February 28). Amazon eyes global expansion for its Temu, Shein competitor. CNBC.

https://www.cnbc.com/2025/02/28/amazon-eyes-global-expansion-for-its-temu-shein-competitor.html

Redaktion LZ. (2025, May 7). Amazons Billigplattform Haul startet in Europa. Lebensmittel Zeitung.

https://www.lebensmittelzeitung.net/handel/online-handel/konkurrenz-fuer-temu--co.-amazons-billigplattform-haul-startet-in-europa-184147

Rudolph et al. (2024). Der Schweizer Online-Handel: Internetnutzung Schweiz 2024. St. Gallen.

Spiegel Wirtschaft. (2024, November 23). Temu und Shein ruinieren den Black Friday.

https://www.spiegel.de/wirtschaft/black-friday-temu-und-shein-ruinieren-den-tag-a-00dbec1d-4136-41bb-b903-053c8b1728a5

Von Thun, J. (2025, January 13). Weil Temu-Angebote zu günstig sind: Amazon geht jetzt drastischen Schritt. Chip.

https://www.chip.de/nachrichten/business,9240/amazon-reagiert-auf-billig-angebote-bei-temu-das-sind-die-konsequenzen_bc9c02bf-db52-43d2-be4e-70ce2826708f.html

Weidemann, T. (2024, November 15). Amazon Haul kopiert chinesische Billigshops – will aber eine Sache besser machen. Digital pioneers.

5. How is Temu's supply chain organised?

Anyone who thinks that an order from Temu in China takes weeks or even months is mistaken. Temu usually delivers within 5-11 working days, and in over 80% of cases even within 8 days. If it takes longer than 12 days, you will automatically receive a credit of 5 CHF, and if it takes more than 15 days, the entire purchase will be refunded. The guaranteed delivery within eleven days can therefore be considered the norm. How is it possible to keep this promise?

Temu's supply chain is an important competitive factor compared to other Chinese platforms such as AliExpress. While traditional marketplace models result in longer delivery times and higher logistics costs, Temu claims to stand out through speed, reliability and transparent communication throughout the entire distribution chain. The results of our survey on internet usage confirm high customer satisfaction with Temu in terms of delivery times.

Temu bypasses traditional supply chains (from producer to wholesaler to retailer and then to customer). The company connects suppliers, so-called sellers, directly with end consumers. Without intermediaries, the supply chain can be made leaner and more efficient. This leads to lower prices and faster delivery times compared to platforms such as AliExpress or traditional European retailers, but also to Amazon. Until the beginning of 2024, Temu operated exclusively on a consignment model. This means that the supplier remains the owner of the goods until they are sold or consumed by the customer. In the US, Temu launched a marketplace model in March 2024 in addition to the consignment model, which enables even faster delivery times and, in the long term, also offers local retailers the opportunity to sell goods via the Temu platform. This model is now also in use in Germany, France, Italy and Spain. According to the PR department, Temu plans to expand into many other countries. In Croatia, Temu has even been cooperating with the local postal service since March 2025 to enable faster deliveries (Retail News, 2025a). In Spain, Temu is also entering into a new partnership with the logistics company Correos (Retail News, 2025b).

Due to new customs laws in the United States, Temu wants to adapt its supply chain model. The so-called ‘half-custody’ model is to be promoted in the United States, whereby suppliers and manufacturers now send their goods to American warehouses themselves and Temu no longer handles all aspects for them. Ultimately, the model is to be made mandatory throughout the United States and no longer voluntary. This change could lead to higher prices and fewer small Chinese retailers on the platform, as they now face higher costs due to Trump's new laws (The Standard, 2025).

By using optimised logistics – particularly air freight and modern digital technologies for real-time optimisation – Temu accelerates transport processes. According to Temu, more than 50% of all goods are shipped to Europe via air freight (Temu PR Department, August 2024). From the customer’s perspective, shipping with Temu can be tracked with precision. Just minutes after placing an order, the customer receives a notification that the goods have begun their journey. Every subsequent step is communicated in detail. Air freight enables short delivery times of less than a week to Switzerland. However, this speed comes at the cost of higher CO₂ emissions, as air freight leaves a significantly larger environmental footprint compared to other transport methods (DHL, 2023).

Direct collaboration with producers, the avoidance of proprietary warehouses, and the use of economies of scale result in significant cost reductions. Temu achieves further savings through centralised logistics handling. Goods ordered by customers are collected in China and packaged together in a single parcel, saving cargo space and shipping costs.

According to Temu’s press department, delivery times to Europe are expected to improve further with the establishment of European warehouses for selected products.

Even Switzerland is being flooded with parcels from China. It is estimated that every second parcel ordered last year came from Temu, and approximately 100,000 Chinese parcels arrive at Zurich Airport daily. This influx is causing general delays, which have even led to late deliveries of essential medicines (Gnehm, 2025).

DHL (2023, July 26). Nachhaltige Transportlogistik – Frachtarten im Vergleich.

https://dhl-freight-connections.com/de/nachhaltigkeit/nachhaltige-transportlogistik-frachtarten-im-vergleich/

https://www.tagesanzeiger.ch/paketflut-aus-china-immer-groesser-sie-droht-die-abfertigung-am-flughafen-lahmzulegen-569802481730

Nikolicic, S., Kilibarda, M., Atanaskovic, P., Dudak, L. & Ivanisevic, A. (2015). Impact of RFID Technology on Logistic Process Efficiency in Retail Supply Chains. Promet-Traffic & Transportation 27(2), 137-146.

Marketplace Pulse. (2024a, March 14). Temu Marketplace Launches in the US.

https://www.marketplacepulse.com/articles/temu-marketplace-launches-in-the-us

https://www.marketplacepulse.com/articles/temu-sets-up-us-warehouses

Li, Z., Zheng, H. (2023, May 23). The Value Chain Construction of Cross-Border E-Commerce Platform “AliExpress”. In: Zhang, J., Ying, K., Wang, K., Fan, Z., Zhao, Z. (eds) Innovation of Digital Economy. Management for Professionals. Springer, Singapore. https://doi.org/10.1007/978-981-99-1741-9_32

Retail-News. (2025a, March 8). Lokalisierung: Temu kooperiert mit Kroatischer Post für schnellere Lieferungen.

https://retail-news.de/lokailisierung-temu-kroatien-logistik/

Retail News. (2025b, March 12). Temu und Correos kooperieren für schnellere Lieferungen in Spanien.

https://retail-news.de/temu-correos-spanien-lieferung-kooperation/

The Standard. (2025, February 11). Temu overhauls supply chain after tariffs, risking price hikes.

https://www.thestandard.com.hk/breaking-news/section/2/227339/Temu-overhauls-supply-chain-after-tariffs,-risking-price-hikes

Tripp, C. (2023, June 13). Temu: Der neue Gigant im Onlinehandel. DVZ.

6. What offences is Temu being accused of?

Temu Faces Growing Pressure from Swiss Retail Associations and Regulatory Bodies

Temu is increasingly coming under pressure due to repeated complaints from consumer protection advocates and official institutions such as Handelsverband.swiss and the Swiss Retail Federation. Recently, 12 retail associations in Switzerland sent a formal letter to the Federal Council urging it to issue an official warning to Temu. They are concerned about the impact on their businesses and demand that Temu comply with the same regulations and standards as domestic companies. Otherwise, they fear an uneven playing field and unfair competition. The associations also criticised safety shortcomings in products—particularly toys—and called for greater transparency to protect and inform the public. Furthermore, they are demanding stricter customs inspections, claiming that Temu is importing illegal goods into Switzerland (Urech, 2024a).

In January 2025, the Swiss Retail Federation published an update on recent developments. It revealed that the growth of online platforms such as Temu ranks among the most pressing concerns for Swiss retailers. Price pressure and growing competition are weighing heavily on the retail sector. Seventy percent of companies believe that Temu and Shein exert a strong influence on the Swiss retail market. Nonetheless, the majority expressed a more optimistic outlook for the future compared to the previous year (Swiss Retail Federation, 2025).

SECO Agreement and App Adjustments

Due to the numerous complaints, SECO (State Secretariat for Economic Affairs) entered into dialogue with Temu and reached an agreement in April 2025 regarding changes to the presentation of its website and app. From now on, discount promotions must include a reference price, and more detailed information about sellers must be disclosed. Certain promotional phrases and gamification features—such as the spin-the-wheel game, which generated purchase pressure—have now been removed from the app in Switzerland. Since Temu agreed to these changes, SECO has decided not to pursue legal action. The Swiss Retail Federation is also satisfied with the declaration to cease and desist, viewing it as a first step towards fairer conditions (SRF News, 2025; Poeschl, 2025).

Changes to VAT and Regulatory Response

Until recently, Temu was also able to bypass VAT obligations due to its low pricing strategy. This changed in January 2025 with an amendment to the VAT Act. Previously, foreign online shops like Temu were only required to pay VAT on goods valued above CHF 62. Now, a VAT of 8.1% must be paid if a platform ships goods worth more than CHF 100,000 annually to Switzerland—an amount Temu easily exceeds. However, this new rule also affects Swiss platforms such as Ricardo (Kälin, 2025). Germany is likewise planning to tackle the customs duty exemption threshold and will increase coordinated inspections as a measure to promote fair competition. A concrete plan is expected to be adopted by the German government at the end of January (Spiegel, 2025). The European Union as a whole is planning to crack down on tax and customs loopholes, though these changes are not expected to take effect until 2028 (Röse, 2024).

Temu’s Terms of Use and Data Protection Concerns

Temu is also adjusting its terms of service in response to the allegations raised in Switzerland. Swiss law will now apply. However, the Swiss trade association has criticised this as mere “Swiss-washing,” arguing that Temu still avoids responsibility and excludes itself from liability (Pöschl, 2024b).

In early December 2024, the Swiss National Test Institute for Cybersecurity (NTC) conducted an independent security analysis. Two features of Temu’s app were identified as red flags: firstly, the app is capable of modifying its own behaviour through dynamic code, and secondly, it includes additional encryption methods. While these could enhance data protection, they also increase the risk of concealing unwanted data transmissions. These features are not necessarily malicious, and further investigation is needed to determine their implications (Dakic, 2024). The organisation noyb has also accused Temu of transmitting European user data to China—something prohibited under EU law. It has filed a complaint against Temu in Austria in response (noyb, 2025).

EU Action Under the Digital Services Act

On 31 October 2024, the European Commission launched formal proceedings against Temu, alleging that the platform had violated the EU Digital Services Act (DSA). The DSA obliges large online platforms (those with over 45 million users) to take targeted action against the sale of illegal content and products. In May 2024, the EU classified Temu as such a platform. Temu now has one month to respond to the allegations. The company must address the findings of the investigation and explain how it intends to resolve consumer protection issues in order to comply with the regulations (Kammer, 2024). In early December, Temu responded by publishing a transparency report in accordance with its obligations under the DSA, outlining the measures it has taken (Retail News, 2024b).

- Insufficient measures against fraudulent sellers: Temu is accused of failing to take adequate action against fraudulent sellers who continue to distribute products and content that violate EU regulations.

- Health risks due to addictive potential: The gamification approach of the website and app, which uses mechanisms similar to those found in casinos, allegedly entices users to make purchases and increases the amount of time they spend on the platform.

- Lack of transparency in product recommendations: The platform provides no information on the criteria used to generate product recommendations. This lack of disclosure violates the requirements of the Digital Services Act (DSA) and raises concerns about fairness.

- Restricted access to data: Temu reportedly denies access to certain data that, under the DSA, must be made publicly available. These data are essential for ensuring the traceability of products and sellers.

These repeated accusations raise fundamental concerns about the platform’s transparency and legal compliance. As a result, potential EU sanctions for Temu’s breaches of the DSA could jeopardise its presence in the European market (FAZ, 2024).

What follows is a broader overview of additional accusations, ranging from misleading consumer information and copyright violations to product counterfeiting, missing safety labels, unethical labour practices, and environmental harm.

These repeated accusations raise fundamental concerns about the platform’s transparency and legal compliance. As a result, potential EU sanctions for Temu’s breaches of the DSA could jeopardise its presence in the European market (FAZ, 2024).

Temu does not guarantee product safety and thereby evades product liability (Valda, 2024a). Spot checks conducted by independent organisations have shown that technical products frequently fail to meet safety standards (da Silva & Büchenbacher, 2023; Hügli & Flohr, 2024). Toxicology tests on various items revealed that in more than half of the tested products, legal limits were exceeded, with carcinogenic substances or plasticisers detected. Temu has announced it will review the cases (Bund, 2024). In some instances, essential product certifications are missing (Pöschl, 2024a), while in others, documents may have been falsified (da Silva & Büchenbacher, 2023). Purchasing dangerous goods—such as defective batteries that could cause house fires—could lead to insurance issues. If consumers pass on such products, they may even be held criminally liable (MDR, 2024; Blick, 2024). Serious accidents involving Temu products occur repeatedly. In January, a young girl suffered severe burns caused by a jumper (Meier, 2025).

Legal Basis:

Temu, like eBay, positions itself as a marketplace rather than a direct seller, thereby avoiding responsibility for product safety (Valda, 2024a; Hügli & Flohr, 2024). Due to Temu’s foreign headquarters, enforcing product safety laws proves difficult (Valda, 2024a), especially as Swiss customs only carry out spot checks, which further hinders the enforcement of safety standards. When consumers pass on unsafe or counterfeit products purchased from Temu, they assume the role of importer and thus bear legal responsibility themselves (MDR, 2024; Blick, 2024).

Temu sells products that resemble well-known brands as well as items of inferior quality, such as squeaky sports shoes, headphones with poor sound quality, and goods that are smaller than depicted in the images (Weder, 2024; da Silva & Büchenbacher, 2023). Accusations of trademark counterfeiting are also frequent (Kaiser, 2024). Retailers report numerous copies of their protected products appearing on Temu. Even when illegal items are reported and removed, they are often simply relisted (Handelsblatt, 2024a).

The Swiss Trademark Protection Act prohibits the use of protected brands without authorisation. Since Temu did not previously have a registered office in Switzerland, SECO was unable to enforce sales bans (Pöschl, 2024a). With the establishment of the subsidiary Whaleco Switzerland AG in Basel in early 2024, Temu could become more accessible to SECO in the future. However, as of March 2025, there is no longer a Swiss board of directors, potentially reducing legal accountability again (Jacobi, 2025).

Temu faces accusations of misleading customers through manipulative advertising tactics. This includes unclear recommended retail prices, unauthorised advertising, and manipulative sales triggers such as continuous discounts, limited stock availability, and gamification elements that pose addictive potential (Valda, 2024a; Pöschl, 2024a; Weder, 2024). Despite a ban on manipulative design, recent studies show that such practices remain problematic (vzbv, 2025).

In Switzerland, the Price Disclosure Ordinance (PVB) requires that prices before discounts be clearly indicated. Due to Temu’s ongoing discount strategies and the time pressure exerted on consumers through limited-time offers, Dagmar Jenni of the Swiss Retail Federation questions whether these practices violate the Unfair Competition Act (Weder, 2024).

Swiss retailers accuse Temu of failing to comply with environmental protection laws and of not paying the advance recycling fee (Valda, 2024a; Pöschl, 2024a).

In Switzerland, environmental protection and product take-back regulations are strict and clearly defined. The Environmental Protection Act and related ordinances, such as the ordinance on the Take-Back and Disposal of Electrical and Electronic Equipment, require companies to assume financial and organisational responsibility for the life cycle of their products. In contrast, environmental standards in China are often vague and rarely enforced (Urech, 2024b).

According to the Swiss Retail Federation, Temu benefits from a competitive advantage due to exemption from value-added tax (VAT), which further increases the price gap compared to domestic suppliers. However, this changed at the beginning of 2025, and Temu is now required to pay VAT as well (Kälin, 2025). Nevertheless, the low prices continue to pose a threat to Swiss retailers.

In Switzerland, the collection of VAT on imported goods is regulated by the VAT Act. For orders from abroad, the Customs Act in conjunction with the VAT Ordinance determines from which amount and at what rate VAT is levied. For foreign orders up to a value of CHF 62, customers were previously not required to pay VAT — a rule that also applied to Temu. By contrast, for domestic orders, VAT is due from the very first franc (Pöschl, 2024a; Urech, 2024b). Now, any platform that delivers goods worth more than CHF 100,000 per year into Switzerland is also required to pay VAT (Kälin, 2025).

Temu stands accused of neglecting its due diligence obligations within its supply chains, particularly with regard to the prevention of child and forced labour. US lawmakers have criticised Temu for having introduced a code of conduct without conducting audits, even though products originate from the Xinjiang region, which is known for forced labour (Urech, 2024b; Retail News, 2024c).

The Swiss Code of Obligations obliges companies to monitor their supply chains and exercise the necessary due diligence to prevent illegal practices. In China, however, transparency on such matters is limited (Urech, 2024b). Since Temu is headquartered in China, enforcement actions against the company are more difficult (Pöschl, 2024a; Weder, 2024). Temu asserts that it demands high standards through its code of conduct and plans to take action against suppliers in the event of violations (Retail News, 2024c).

Within Switzerland: The State Secretariat for Economic Affairs (SECO) is currently in contact with Temu but is not providing any further public statements at this time (Valda, 2024a). In early 2024, Temu established a Swiss entity, Whaleco Switzerland AG, with a base in Basel (Pöschl, 2024a; Valda, 2024b). This could potentially make the company more accessible for SECO (Pöschl, 2024). It is expected that Temu will be required to display discount prices more transparently in the future (Valda, 2024b). Temu itself claims that the Swiss subsidiary aims to offer better service and ensure greater compliance with local regulations. However, further developments remain unclear (Pöschl, 2024a). Swiss political parties are united in their efforts and have formed an alliance to enforce stricter regulations for foreign online retailers in the future (Zahno, 2024).

Worldwide: Outside of Europe, Temu is also facing increasing scrutiny. On 11 November 2024, the Vietnamese government requested Temu to register with the Ministry of Commerce. In order to avoid a suspension of its website and app, Temu was expected to respond by the end of November (Der Standard, 2024). In early December, Temu raised the minimum order value to $35 and set a maximum limit of $40. Vietnamese customers had to complete purchases within this price range. This upper limit is likely related to tax exemptions for e-commerce goods below a certain value (Retail News Asia, 2024). As a consequence, on 5 December 2024, the Vietnamese government announced a temporary suspension of Temu for missing the deadline. On its website, Temu stated that the application had been submitted and is now under review by the ministry in accordance with regulations (Retail News, 2024a).

https://www.nzz.ch/international/suedostasiatische-laender-gehen-gegen-die-chinesische-app-temu-vor-und-kommen-den-usa-und-der-eu-zuvor-ld.1864154

Bender, H. (2025, April 9). Handelsverband reicht Kartellbeschwerde gegen Temu ein. Lebensmittel Zeitung.

https://www.lebensmittelzeitung.net/politik/nachrichten/chinesische-online-plattform-handelsverband-reicht-kartellbeschwerde-gegen-temu-ein-183615

Bund. (2024, December 11). Partyartikel voller verbotener Schadstoffe: BUND-Test findet Schadstoffe in Produkten von Shein, Temu und AliExpress.

https://www.bund.net/themen/aktuelles/detail-aktuelles/news/partyartikel-voller-verbotener-schadstoffe-bund-test-findet-schadstoffe-in-produkten-von-shein-temu-und-aliexpress/

Dakic, D. (2024, December 5). Temu weist technische Auffälligkeiten auf. IT-Markt.

https://www.it-markt.ch/news/2024-12-05/temu-weist-technische-auffaelligkeiten-auf

Da Silva, G., & Büchenbacher, K. (2023, December 15). Onlineshop Temu: Sneakers für acht Franken, eine Smartwatch für 16 Euro – wo ist der Haken? NZZ.

https://www.nzz.ch/technologie/temu-app-wie-gefaehrlich-ist-der-online-shop-aus-china-nzz-ld.1769682

Der Standard. (2024, November 11). Vietnamesische Regierung droht mit Sperrung von Temu und Shein. https://www.derstandard.at/story/3000000244429/vietnamesische-regierung-droht-mit-sperrung-von-temu-und-shein

Die Presse. (2025, February 12). So wirkt der S-Zollangriff auf Shein und Temu.

https://www.diepresse.com/19355764/so-wirkt-der-us-zollangriff-auf-shein-und-temu

FAZ. (2024, November 1). EU-Kommission eröffnet Verfahren gegen Temu. FAZ.

https://zeitung.faz.net/faz/wirtschaft/2024-11-01/f06b5cbeefee5af396280902e281ea98/?GEPC=s5

Focus online. (2025, April 17). Trumps Zollpolitik zwingt Temu und Shein zu Preiserhöhungen. Focus online.

https://www.focus.de/finanzen/news/das-wars-fuer-schnaeppchenjaeger-trumps-zollpolitik-zwingt-temu-und-shein-zu-preiserhoehungen_7c51de84-469d-4fb0-91d4-ef5d99ad75ad.html

Handelsblatt. (2024, December 8). Plagiate bei Temu. So dreist wird auf der chinesischen Handelsplattform gefälscht.

https://www.handelsblatt.com/unternehmen/handel-konsumgueter/plagiate-bei-temu-so-dreist-wird-auf-der-chinesischen-handelsplattform-gefaelscht/100093526.html

Hügli, A., & Flohr, F. (2024, April 25). Temu-Schnäppchen: Gefährlich für Gesundheit und Umwelt. SRF. https://www.srf.ch/sendungen/kassensturz-espresso/kassensturz/china-plattform-im-fokus-temu-schnaeppchen-gefaehrlich-fuer-gesundheit-und-umwelt

Jacobi, M. (2025, March 7). Letzter Schweizer Verwaltungsrat geht: Temu dezimiert seinen Fussabdruck in der Schweiz. Aargauer Zeitung.

https://www.aargauerzeitung.ch/wirtschaft/e-commerce-temu-dezimiert-seinen-fussabdruck-in-der-schweiz-ld.2741554

Kälin, M. (2025, January 7). Jetzt müssen auch Temu und Co. Mehrwertsteuer bezahlen. Blick.

https://www.blick.ch/wirtschaft/neue-regelung-fuer-onlineshops-jetzt-muessen-auch-temu-und-co-mehrwertsteuer-bezahlen-id20459676.html

Kaiser, J. (2024, March 11). Was steckt hinter dem Billiganbieter Temu? SWR.

https://www.swr.de/swr1/rp/programm/was-steckt-hinter-dem-billiganbieter-temu-100.html

Kammer, A. (2024, November 8). Händler Temu verstösst gegen EU-Regeln zum Verbraucherschutz. Zeit online. https://www.zeit.de/digital/2024-11/e-commerce-temu-eu-kommission-recht

Manager. (2025, April 9). Trump verhängt 90-Prozent-Zölle auf Billigwaren aus China. Manager.

https://www.manager-magazin.de/finanzen/handelskrieg-eskalation-durch-trumps-neue-zoelle-auf-chinesische-produkte-a-27108b48-8afc-4bc7-9edc-0338db6d30ff

MarketScreener. (2025, January 2). Britische Gesetzgeber laden Shein und Temu zur Befragung über Arbeitspraktiken vor.

https://ch.marketscreener.com/kurs/aktie/MCDONALD-S-CORPORATION-4833/news/Britische-Gesetzgeber-laden-Shein-und-Temu-zur-Befragung-uber-Arbeitspraktiken-vor-48675920/

McLymore, A. (2025, May 6). Exclusive: Shein, Temu ramp up advertising in UK and France as US tariffs hit. Reuters.

https://www.reuters.com/business/media-telecom/shein-temu-ramp-up-advertising-uk-france-us-tariffs-hit-2025-05-05/

MDR. (2024, July 7). Vorsicht beim Einkaufen bei Temu. MDR.

https://www.mdr.de/ratgeber/lifestyle/temu-onlineshop-china-billigware-erfahrung-234.html

Meier, S. (2025, January 13). Mädchen (8) fängt in Temu-Pullover Feuer.

https://www.blick.ch/ausland/die-haut-fiel-einfach-von-ihr-ab-maedchen-8-faengt-in-temu-pullover-feuer-id20482513.html

noyb. (2025, January 16). TikTok, AliExpress & Co liefern europäische Daten an China aus.

https://noyb.eu/de/tiktok-aliexpress-shein-co-surrender-europeans-data-authoritarian-china

Palmer, A. (2025, May 2). Temu halts shipping direct from China as de minimis tariff loophole is cut off. CNCB.

https://www.cnbc.com/2025/05/02/temu-halts-shipments-direct-from-china-as-de-minimis-tariff-rule-ends-.html

Pech, C. (2025, 15 April). Temu: Google-Werbung gestoppt - Ranking bricht empfindlich ein. Onlinehändler News.

https://www.onlinehaendler-news.de/themen/marktplaetze/temu-google-werbung-gestoppt-ranking-bricht-ein

Plewinski, T. (2025, April 25). Temu uns Shein büssen massiv Marktanteile ein. Onlinehändler News.

https://www.onlinehaendler-news.de/themen/marktplaetze/temu-shein-buessen-massiv-marktanteile

Pöschl, F. (2024a, August 12). «Das ist ein echter Brocken»: Temu gräbt dem Handel Milliarden ab. 20 Minuten. https://www.20min.ch/story/temu-graebt-dem-handel-milliarden-ab-103166959

Pöschl, F. (2024b, November 27). Temu passt sich Schweiz an: Handelsverband kritisiert «Swiss-Washing». 20 Minuten.

https://www.20min.ch/story/china-app-temu-passt-sich-schweiz-an-handelsverband-kritisiert-swiss-washing-103228221

Pöschl, F. (2025, April 17). Bund einigt sich mit Temu auf App-Änderungen. 20 Minuten. https://www.20min.ch/story/nach-beschwerden-gluecksrad-kommt-weg-bund-einigt-sich-mit-temu-auf-app-aenderungen-103326766

Retail News Asia. (2024, November 14). E-commerce platform Temu restricts checkout to $35-40 price range.

https://www.retailnews.asia/e-commerce-platform-temu-restricts-checkout-to-35-40-price-range/

Retail News. (2024a, December 5). Registrierungspflicht verletzt: Vietnam blockiert Temu. Retail News.

https://retail-news.de/temu-vietnam-blockiert-fehlende-registrierung/

Retail News. (2024b, December 3). Temu: Erster "Transparenzbericht" unter DSA-Pflichten veröffentlicht. Retail News.

https://retail-news.de/temu-transparenzbericht-content-eu-dsa/

Retail News. (2024c, April 20). Temu wehrt sich gegen Vorwürfe von Zwangsarbeit und Datenmissbrauch. Retail News. https://retail-news.de/temu-wehrt-sich-gegen-vorwuerfe-von-zwangsarbeit-und-datenmissbrauch/

Retail News. (2025a, March 5). Temu muss Betrieb in Usbekistan einstellen - Regierung rät zum Bestellstop. Retail News.

https://retail-news.de/usbekistan-temu-sperre-bestellstop/

Retail News. (2025b, March 17). USA-Expansion: DigitBridge-Integration erweitert Temu-Vertriebskanäle.

https://retail-news.de/usa-temu-digitbridge-partnerschaft/

Retail News. (2025c, April 2). Usbekistan blockiert Temu: Steuerforderung in Millionenhöhe. Retail News.

https://retail-news.de/temu-usbekistan-steuerschuld/

Röse, C. (2024, December 29). Der Druck auf chinesische Billiganbieter wächst. tagesschau,

https://www.tagesschau.de/wirtschaft/unternehmen/online-haendler-eu-temu-shein-100.html

Ruffiner, O. (2024, June 3). Temu verkauft falsche Fünfliber für knapp 2 Franken. Blick.

Schwarz, F. (2025, April 10). Zweifacher Gegenwind für Temu. FAZ. https://zeitung.faz.net/faz/unternehmen/2025-04-10/e93f2500fd982fbe115c2e38457ad60e/?GEPC=s5

Spiegel. (2025, January 29). Bundesregierung verabschiedet Aktionsplan gegen Temu und Shein. https://www.spiegel.de/netzwelt/netzpolitik/temu-shein-bundesregierung-plant-massnahmen-gegen-paketflut-aus-china-a-fa49cb15-9477-4179-8016-da019c99683e

SRF News. (2025, April 17). Temu ändert Webseite nach Seco-Intervention. SRF News.

https://www.srf.ch/news/schweiz/chinesischer-onlinehaendler-temu-aendert-website-nach-seco-intervention

Swiss Retail Federation. (2025, January 7). Trotz Online-Plattformen im Nacken: Schweizer Detailhändler blicken optimistischer in die Zukunft als im Vorjahr.

https://www.swiss-retail.ch/news/trotz-online-plattformen-im-nacken-schweizer-detailhaendler-blicken-optimistischer-in-die-zukunft-als-im-vorjahr/

Tagesschau. (2024, May 31). EU verschärft die Regeln auch für Temu. Tagesschau.

https://www.tagesschau.de/wirtschaft/verbraucher/temu-dsa-amazon-facebook-tiktok-online-haendler-plattformen-100.html

Urech, M. (2024a, November 15). Brief an den Bundesrat: Händler fordern Massnahmen gegen China-Shops. 20 Minuten.

Urech, M. (2024b, April 13). Temu muss sich in der Schweiz nicht an die Regeln halten. 20 Minuten. https://www.20min.ch/story/ungleiche-spiesse-temu-muss-sich-in-der-schweiz-nicht-an-die-regeln-halten-103083369

Valda, A. (2024a, August 11). Neue Attacke der Schweizer Händler auf Temu. Handelszeitung. https://www.handelszeitung.ch/politik/neue-attacke-der-schweizer-handler-auf-temu-737222

Valda, A. (2024b, August 8). Temu zeigt die Kraft des Wettbewerbs. Handelszeitung. https://www.handelszeitung.ch/politik/temu-zeigt-die-kraft-des-wettbewerbs-737225

Vzbv. (2025, January 22). Von Amazon über Tiktok bis Temu: Manipulative Designs bleiben ein Problem.

https://www.vzbv.de/pressemitteilungen/von-amazon-ueber-tiktok-bis-temu-manipulative-designs-bleiben-ein-problem

Watson. (2025, February 2). Wegen Temu und Shein: US-Post nimmt keine Pakete aus China mehr an. https://www.watson.ch/international/wirtschaft/516061344-wegen-temu-und-shein-us-post-nimmt-keine-pakete-aus-china-mehr-an

Weder, J. (2024, May 8). Schlechte Produkte, aggressive Werbung, schädlich für die Umwelt: Der Online-Shop Temu bricht alle Regeln und wächst trotzdem weiter. Was tun?. NZZ.

https://www.nzz.ch/wirtschaft/temu-die-kritik-an-der-chinesischen-shopping-app-waechst-ld.1829505

Zahno, C. (2024, December 20). Politiker wollen Billigshops enger an die Leine nehmen. Blick.

More regarding the DAS of the European Commission under https://germany.representation.ec.europa.eu/news/dsa-eu-kommission-benennt-temu-als-sehr-grosse-online-plattform-vlop-2024-05-31_de

7. How are returns processed at Temu?

The quality of returns processing significantly influences customer trust and satisfaction and has a positive effect on repurchase intentions (Ahmed et al., 2023). Like other e-commerce platforms, Temu faces the challenge of offering its customers a smooth and reliable returns process.

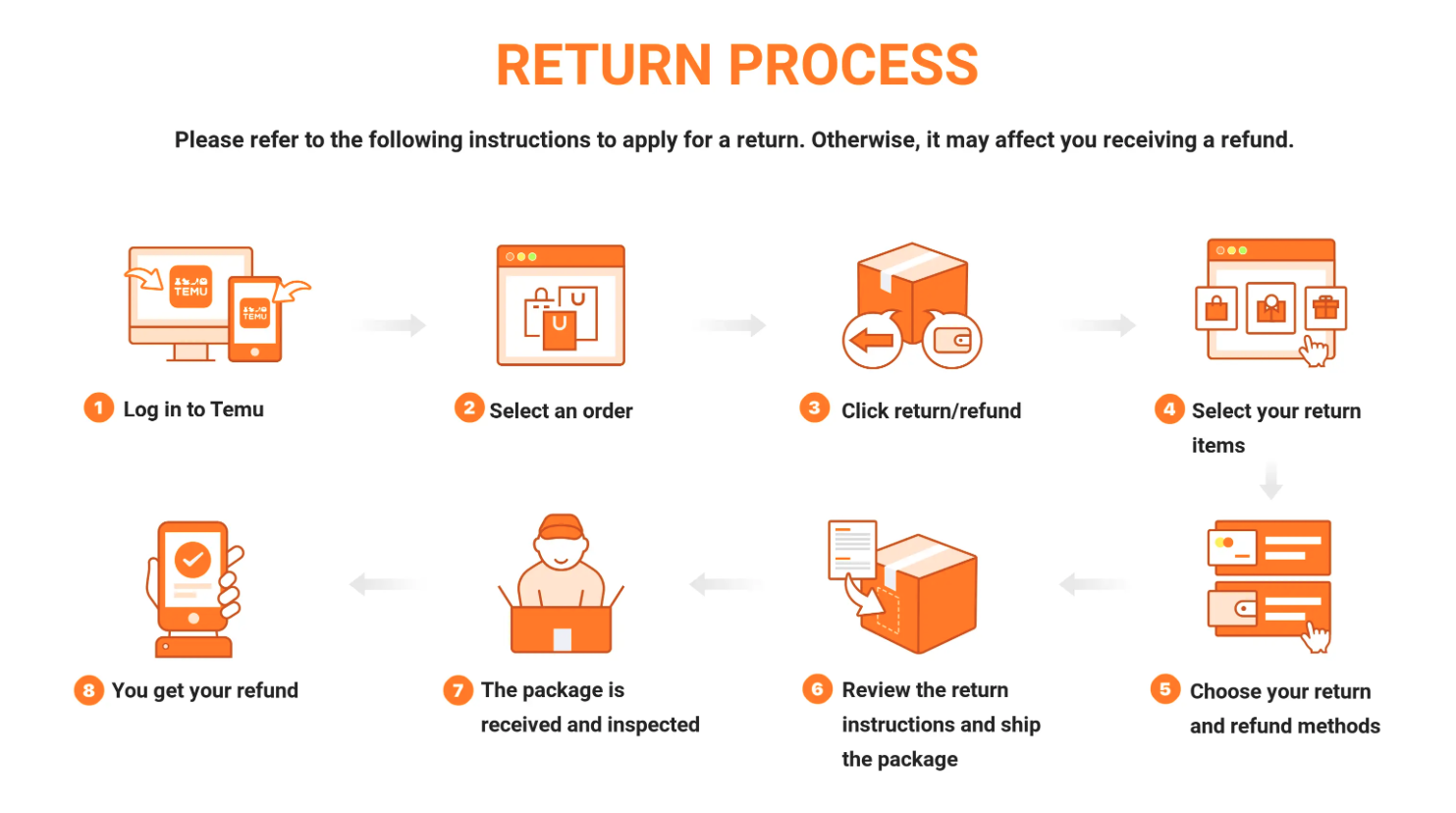

At first glance, the returns process at Temu appears simple and transparent. Returns are generally free of charge. On its website, Temu guides customers through an eight-step return process (see Fig. 5). The similarity to return systems familiar to European consumers reflects Temu’s efforts to provide a seamless shopping experience for this market.

However, a closer look at the return policy reveals some obstacles for customers. For instance, returns are only straightforward if all original barcodes are still present. If not, items without barcodes must be placed in separate, transparent, and marked bags – adding extra effort for the consumer. Furthermore, only one free return label is provided per order. Each additional return from the same order incurs a charge of CHF 6 (Temu, n.d.).

Given Temu’s consistently low product prices, consumers are often less inclined to initiate a return. The low value of the goods is disproportionate to the effort required for repacking, visiting the post office, and waiting for a refund. Many customers therefore choose to dispose of the item rather than go through the complete returns process. The requirement to return products in their original packaging and the CHF 6 fee for additional returns reinforces this behaviour.

It also remains unclear what happens to returned items. Are they sent back to China? In most cases, returns first go to a redistribution centre within the country. There is evidence that the items are not necessarily shipped back to China but may instead be resold to third parties or marketed as clearance stock. Other companies using similar business models destroy only a small portion of returned goods that can no longer be resold (Kühne, 2023; Weidemann, 2024).

https://doi.org/10.1108/YC-2023-0174

Temu. (n.d.). Return and refund policy.

https://www.temu.com/ch/return-and-refund-policy.html

Weidemann, T. (2024, June 22). Retouren bei Temu: Muss ich die Ware wirklich nach China zurückschicken? t3n. https://t3n.de/news/retouren-bei-temu-muss-ich-die-ware-wirklich-nach-china-zurueckschicken-1630783/

8. How questionable is an order from Temu from an ethical and sustainable perspective?

In today’s business landscape, sustainable practices are increasingly seen as essential. Investors, consumers, and regulators are demanding adherence to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) standards. The following examines how Temu addresses these criteria and the challenges it faces.

Temu operates a demand-driven shipping model that delivers goods directly from manufacturers to consumers. This approach potentially reduces unnecessary warehousing and transportation, thereby lowering CO₂ emissions by minimising supply chain stages. The company highlights a partnership with Trees for the Future, which supports reforestation efforts in Africa to offset the carbon emissions linked to its operations.

However, there is a significant lack of transparency regarding Scope 1, 2, and 3 emissions. Other than the tree-planting initiative, no concrete targets or actions for emission reduction have been disclosed. A considerable portion of Temu’s product range falls under (ultra-)fast fashion, often made from synthetic materials like acrylic and polyester, which significantly contribute to environmental degradation. According to SPER Market Research (2023), the Chinese synthetic fibre market is expected to reach USD 39.8 billion by 2033, with a compound annual growth rate (CAGR) of 6.27%, largely driven by the Asia-Pacific region.

Temu also provides no clear data regarding the energy consumption of its data centres. Waste management practices, including information on the handling of returns, recycling, or damaged goods, remain vague. In contrast, other online platforms such as Amazon often disclose what happens to returned products. According to Amazon (2024), the majority of returned items are re-sold as new after thorough inspection.

Temu promotes values such as empowerment, inclusion, diversity, integrity, and social responsibility on its website. However, no publicly documented programmes or independently verified initiatives are available to substantiate these claims. Meanwhile, the company has faced widespread criticism over working conditions in supplier factories, particularly in China, where labour rights protections are often weak.

In response to a U.S. Senate-led investigation concerning forced labour allegations, Temu refers to its Code of Conduct, which prohibits all forms of forced, child, or prison labour (Rubio, 2024). Nevertheless, reports persist of long working hours and low wages (Stone, 2023). Temu claims to require its suppliers to comply with all local laws concerning wages, working hours, and voluntary employment. Still, greater transparency about labour practices across its workforce and supply chain is needed to enhance credibility. It should be noted that European retailers also struggle to ensure complete supply chain visibility when sourcing products from China.

Temu highlights “integrity” as a core corporate value, defined as being “honest, ethical, and trustworthy” (Temu, 2024). According to the company, a Code of Conduct is in place that mandates compliance with local laws. However, there is no evidence of independent audits or compliance checks, which are critical for verifying adherence to ethical standards and regulatory obligations.

Recently, the company has faced growing scrutiny over allegedly unethical practices, including misleading discount displays, manipulative interface design through so-called dark patterns, the absence of proper contact information on its website, unfair competition, and improper price disclosures (VZBV, 2024; Valda, 2024; Weder, 2024). Following warnings and legal notices from authorities in Germany, Austria, and Switzerland, Temu issued formal undertakings to cease the practices in question.

These responses, alongside communication with the company’s press office, indicate a willingness to adapt its practices. Nevertheless, external audits and greater transparency are essential to ensure compliance with both self-imposed standards and generally accepted ethical business principles.

Amazon (2024). Was passiert bei Amazon mit deinen Retouren?

https://www.aboutamazon.de/news/nachhaltigkeit/was-passiert-bei-amazon-mit-deinen-retouren

Vzbv (2024, March 26). vzbv mahnt Online-Marktplatz Temu ab. Mehrere Verstöße auf der Plattform bean-standet. https://www.vzbv.de/pressemitteilungen/vzbv-mahnt-online-marktplatz-temu-ab

VKI Verbraucherrecht (2024 June 25). Unterlassungserklärung von Temu.

https://verbraucherrecht.at/unterlassungserklaerung-von-temu/67888#:~:text=Der%20Verein%20f%C3%BCr%20Konsumenteninformation%20(VKI)%20hatte%20im%20Auftrag%20des%20Sozialministeriums,diverser%20Klauseln%20und%20Gesch%C3%A4ftspraktiken%20geklagt

Michel, P. (2024, July 25). Chinesischer Billighändler Temu macht ein seltsames Angebot, um eine Klage in der Schweiz abzuwehren.

https://www.aargauerzeitung.ch/wirtschaft/onlinehandel-das-seco-bruetet-ueber-einer-klage-gegen-temu-dann-macht-die-billig-plattform-ein-seltsames-angebot-ld.2649330?reduced=true

Temu unternehmenseigene Webseite zur Baumpflanzaktion: Temus Baumpflanz-Programm

Rubio Press Release (2024, April 16). Rubio: Investigate Shein and Temu for Slave Labor.

https://www.rubio.senate.gov/rubio-investigate-shein-and-temu-for-slave-labor/

Liu, J (2024, August 1). ‘I’m really desperate now’: Temu sellers revolt against fines and withheld pay. CNN. https://edition.cnn.com/2024/08/01/tech/china-temu-suppliers-protest-hnk-intl/index.html

Oeko Tex (2024, April 16). Operation Analysis of China’s Chemical Fiber Industry in 2023. China Textile Leader. https://www.texleader.com.cn/en/news-34199.html

Retail-News Redaktion (2024 April 20). Temu wehrt sich gegen Vorwürfe von Zwangsarbeit und Datenmissbrauch.

https://retail-news.de/temu-wehrt-sich-gegen-vorwuerfe-von-zwangsarbeit-und-datenmiss-brauch/#:~:text=Der%20chinesische%20E%2DCommerce%2DRiese,Daten%20der%20Nutzer%20umgehen%20w%C3%BCrde

SPER Market Research (2023, May). China Synthetic Fiber Market Size- By Fiber Type, By Application- Region-al Outlook, Competitive Strategies and Segment Forecast to 2033.

https://www.sperresearch.com/report-store/china-synthetic-fiber-market.aspx

Stone, M. (2023, August 31). Der chinesische Online-Händler Pinduoduo, der hinter Temu steht – und seine „hyper-aggressive“ Arbeitskultur. Businessinsider.

https://www.businessinsider.de/karriere/international-career/temu-hyperaggressive-arbeitskultur-und-9127-zeitplan/

Temu (2024). Unsere Werte.

https://www.temu.com/ch/about-temu

Valda, A. (2024, August 11). Neue Attacke der Schweizer Händler auf Temu. Handelszeitung.

https://www.handelszeitung.ch/politik/neue-attacke-der-schweizer-handler-auf-temu-737222

Weder, J. (2024, May 8). Schlechte Produkte, aggressive Werbung, schädlich für die Umwelt: Der Online-Shop Temu bricht alle Regeln und wächst trotzdem weiter. Was tun?. NZZ.

https://www.nzz.ch/wirtschaft/temu-die-kritik-an-der-chinesischen-shopping-app-waechst-ld.1829505

Fickling, D. (2024, April 1). China's Shein and Temu are driving oil, not Toyota and GM. https://www.japantimes.co.jp/commentary/2024/04/01/world/china-oil-demand/

9. How can European retailers and manufacturers benefit from Temu?

The collaboration with Temu presents significant challenges for European retailers. Unlike established platforms such as Amazon, the selling process via Temu is considerably more complex and currently less accessible.

Although Temu continues to expand its logistics network and is increasingly opening distribution centres in Europe, selling on the platform remains a difficult undertaking for European merchants. One of the main barriers lies in Temu’s pricing strategy, which fundamentally differs from the mechanisms of other marketplaces.

Temu sets the prices of the goods offered on its platform itself, requiring European retailers to significantly lower their cost structures in order to remain competitive. Even as Temu begins to open its platform to European sellers, only a small number will likely be able to operate profitably under the platform’s pricing model. These prices are heavily influenced by the highly competitive Chinese market, making profitability for European sellers challenging.

In parallel with price pressure, the operational structure adds complexity. While Temu is experimenting with decentralised fulfilment systems in Europe, concerns around product quality remain. A more decentralised model increases the risk of inconsistencies in the fulfilment process. In response to growing criticism in the US concerning its aggressive pricing model, Temu appears to be transitioning to a semi-centralised fulfilment system. This shift involves building partnerships with local producers and fulfilment providers in Europe to shorten delivery times. However, such partners are expected to operate their own distribution infrastructure (eTowerTech, 2024).

Another major challenge is Temu’s multi-step onboarding process for sellers. While platforms like Amazon allow businesses to set up an account using a corporate tax ID relatively easily, registration on Temu takes place via an email-based process followed by a detailed screening procedure. This process is designed to ensure the supplier’s ability to meet delivery standards and maintain consistent product quality. While burdensome, this is part of Temu’s strategy to avoid fulfilment failures.

The more decentralised the delivery system, the greater the risk of quality losses in fulfilment. Nevertheless, following protests in the USA against its aggressive pricing policy, Temu appears to be switching to semi-centralised fulfilment systems in order to accommodate local suppliers. This means that Temu is setting up co-operations with local manufacturers or fullfillers in order to shorten delivery times, for example. These suppliers must then make their own distribution network available (eTowerTech, 2024).

Despite the obstacles, Temu also offers innovative features that European e-commerce businesses can learn from. One such example is the platform’s use of gamification, which has been shown to enhance cross-selling and increase customer loyalty (Rahmadhan et al., 2023). However, retailers should remain cautious to ensure that these mechanisms are not exploitative or misleading, especially regarding potential gambling-like features that may affect consumer welfare.

In summary, selling via Temu is significantly more difficult for European merchants than using platforms such as Amazon or Kaufland. The low price expectations and the complex onboarding process represent major barriers. Nonetheless, Temu offers forward-thinking concepts from which European online retailers can derive valuable insights – particularly in user engagement and fulfilment innovation.

https://www.etowertech.com/industry-news/temu-unveils-quot;semi-managed-quot;-mode:-a-new-horizon-for-cross-border-e-commerce-logistics.html

10. How can European retailers adapt to Temu?

Since the end of May 2024, Temu has been obliged by a new EU classification to implement stricter requirements, including measures to protect against counterfeiting and infringements of intellectual property rights. In addition, Temu must submit risk assessment reports by the end of September 2024 that examine potential risks to the health and safety of consumers, especially minors. Non-compliance could result in penalties of up to six per cent of annual global turnover. Repeated violations can lead to a ban in the EU (Tagesschau, 2024). In Switzerland, Temu established an unofficial headquarters in Basel with the company Whaleco Switzerland (Pöschl, 2024; Valda, 2024). This could also make the company more tangible for the State Secretariat for Economic Affairs (SECO) and the Swiss guidelines (Pöschl, 2024). However, this Swiss location was dissolved again. Since March 2025, however, there has no longer been a Swiss Board of Directors, which could again affect tangibility (Jacobi, 2025).

Temu gained enormous popularity through its huge advertising spend of USD 505 million in 2023 (Poinski, 2024). On TikTok alone, there are 500 million mentions of Temu's hashtag every fortnight in Germany (Kolf & Müller, 2023). It is to be expected that this level of awareness will persist for the time being and that the slogan ‘Shop like a billionaire’ will become firmly anchored in the minds of consumers. Our study on internet usage shows that one year after entering the market, Temu is already one of the top 5 most-used online retailers in Switzerland. The high profits of the parent company enable further investments for high market growth.

Despite criticism from consumer centres, consumers are asking themselves why they are paying significantly higher prices on European platforms, especially as some European brand suppliers also order in China and sell via European platforms (Valda, 2024). Manufacturers and local online providers need to consider whether the prices of their products are perceived as fair by consumers. If consumer perception of product quality is similar, it can be assumed that price fairness is low.

The reactions of retailers vary. Let's take a look at two fashion retail platforms and their reactions.

Jacobi, M. (2025, March 7). Letzter Schweizer Verwaltungsrat geht: Temu dezimiert seinen Fussabdruck in der Schweiz. Aargauer Zeitung.

https://www.handelsblatt.com/unternehmen/handel-konsumgueter/onlinehaendler-wie-shein-temu-und-alibaba-amazon-angreifen-wollen-/29258684.html

Poinski, M. (2024, February 21). Why Temu Is Spending On Marketing Like A Billionaire. Forbes.

https://www.forbes.com/sites/cmo/2024/02/21/why-temu-is-spending-on-marketing-like-a-billionaire/?sh=44d02e702ae0

Tagesschau. (2024, May 31). EU verschärft die Regeln auch für Temu.

https://www.tagesschau.de/wirtschaft/verbraucher/temu-dsa-amazon-facebook-tiktok-online-haendler-plattformen-100.html

Valda, A. (2024, August 8). Temu zeigt die Kraft des Wettbewerbs. Handelszeitung.

https://www.handelszeitung.ch/politik/temu-zeigt-die-kraft-des-wettbewerbs-737225

Want to stay informed about upcoming trend reports?

Sign up for our newsletter and receive monthly updates

with key insights from the Institute of Retail Management.

Kontakt

-

Universität St.GallenInstitut für Handelsmanagement (IRM-HSG)Gottlieb Duttweiler LehrstuhlDufourstrasse 40aCH-9000 St.Gallen

-

redx-irm@unisg.ch

-

+41 71 224 28 56